Why MFA and Consent Management Are Now Mandatory

- Multi-factor authentication is no longer optional; insurers require it across all business accounts, from email and accounting platforms to remote access gateways. Lack of MFA can result in denial of claims or outright refusal to issue a policy.

- Insurers are also scrutinizing online privacy practices: organizations are being asked to demonstrate the use of a consent management platform (like those offered by Captain Compliance here) that can identify, control, and turn off unauthorized web trackers, pixels, and cookies in compliance with global privacy laws.

Key Cyber Insurance Coverage Requirements in 2026

- Multi-Factor Authentication (MFA): Must be enforced on all user accounts; insurers expect documented proof that MFA is active and comprehensive.

- Consent Management Platform (CMP): With regulators and consumers scrutinizing data collection, insurers want companies to deploy CMPs to control third-party trackers and prove compliance with opt-in/opt-out consent requirements.

- Patching and Vulnerability Management: Businesses need to show automated patching and ongoing vulnerability assessments to eliminate easy exploit vectors.

- Security Training: Insurers require regular, documented cybersecurity awareness programs, particularly for phishing and social engineering readiness.

Web Trackers, Litigation, and Insurers’ New Focus

- Recent lawsuits and regulatory fines—especially in the U.S. and EU—over improper tracking (often without user consent) have increased insurers’ focus on tracking technologies.

- Carriers now frequently request proof that all trackers, pixels, and cookies are identified, cataloged, and that user choices via CMPs are enforced and logged for audit trail purposes.

- Failure to control or document trackers can lead to policy exclusions or denials related to wrongful data collection, even if the incident results from third-party code.

Consent Management Platforms: Emerging Standard

- Modern CMPs do more than show banners; they allow for granular control and logging of consent preferences, feeding compliance data into the insurer’s risk assessment process.

- Platforms like ours here Captain Compliance provide automated tracker scans, consent history storage, preference management, and integration with marketing and analytics stacks, which are now must-haves for regulated and insured businesses. We also integrate with Google Consent Mode and are 1 of only 2 CMP’s that pass the IAB’s TCF validator test!

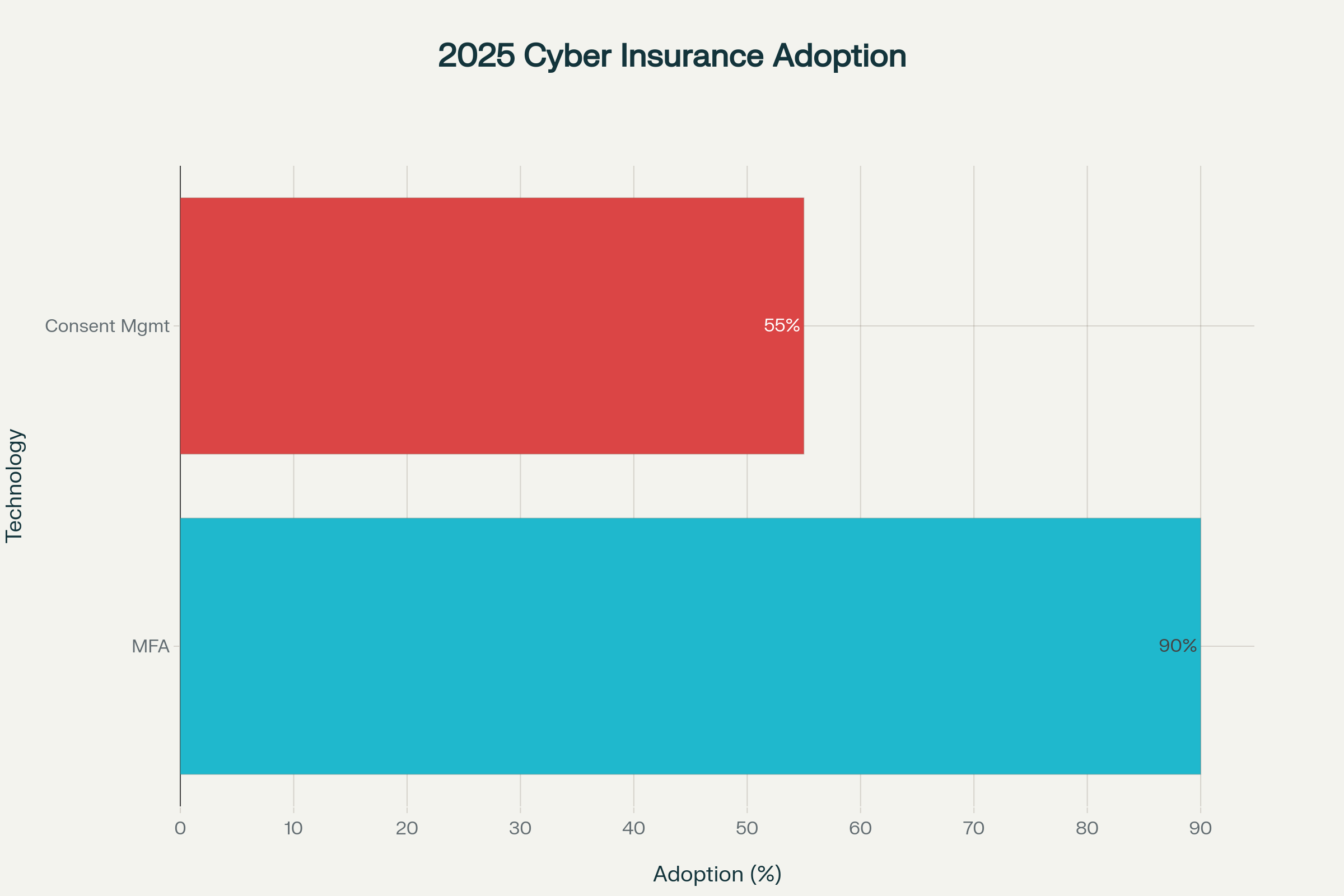

Cyber Insurance Technology Adoption 2025

Shows 2025 adoption rates for MFA (90%) and Consent Management Platforms (55%) required for cyber insurance.

Consequences of Non-Compliance

- Lack of MFA or a functioning CMP can mean an outright claim rejection—even after a breach—or can cause retroactive loss of coverage.

- Some insurers will audit or require proof of compliance during renewal, and reported noncompliance can trigger remediation demands or higher premiums. If your insurance company doesn’t require a consent management platform for whatever reason make sure that you add one from Captain Compliance and ask if a lower rate may be available as this is a protection against litigation claims over privacy violations when using our software properly.

Businesses and Privacy Leaders Cyber Insurance Implementation

To secure cyber insurance—and ensure claims will be honored—organizations must implement and document:

- Robust multi-factor authentication

- A comprehensive consent management platform for tracker and cookie control

- Routine patching, vulnerability management, documented employee training, and strong password, endpoint, and backup policies

Insurance carriers see these controls as essential—not only to mitigate breach risk, but also to prevent regulatory action for data privacy violations. Adoption of specialized solutions such as those from our team here is quickly becoming a baseline requirement for both compliance and insurability in the digital age.