Captain Compliance is here to help your company with privacy and general compliance help by automating requirements using our software solutions. Book a demo to learn more.

Data privacy compliance is crucial because it acts as a mandatory defense against significant legal and financial risks for any organization handling personal data. Global regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), impose strict requirements on how data must be collected, stored, processed, and protected. Failure to comply can result in huge financial penalties, which often include massive fines that can reach tens of millions of dollars or a significant percentage of annual global revenue. Beyond monetary penalties, non-compliance exposes companies to costly regulatory investigations, audits, and protracted civil lawsuits from individuals whose data has been mishandled. Essentially, robust data privacy compliance is an essential legal and risk management strategy that prevents operational disruption and secures the organization’s financial stability in a highly regulated digital landscape.

Data privacy compliance is vital for building and maintaining customer trust and brand reputation in an era where consumers are increasingly aware of their digital rights. When an organization demonstrates a strong commitment to protecting personal information—through transparent policies, robust security measures, and respecting user control—it fosters a trusting relationship that encourages customer loyalty and engagement. Conversely, a data breach or publicized violation of privacy laws can lead to severe reputational damage, negative media coverage, and an immediate loss of consumer confidence, which can take years to recover from. Prioritizing compliance signals an ethical approach to data handling, which in turn provides a competitive advantage by attracting privacy-conscious customers and establishing the company as a responsible and reliable institution.

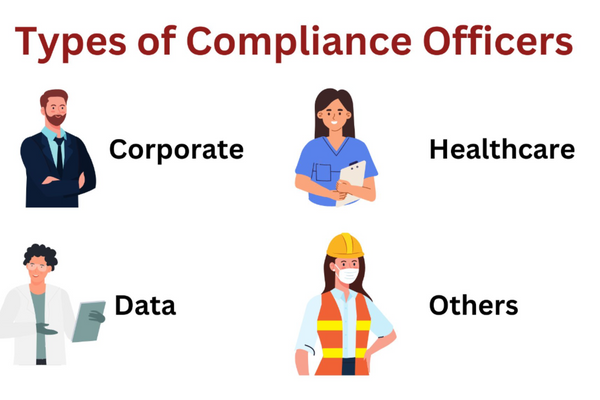

Below this image you’ll learn about other compliance officer roles for your organization and what they can help handle.

A compliance officer, often referred to as a guardian of compliance, is a pivotal position within businesses.

Compliance officers serve as watchdogs, ensuring adherence to laws, regulations, and internal policies. They play a vital role in creating a culture of compliance and upholding the business’s reputation and integrity.

In this article, we’ll explore the primary responsibilities of compliance officers, including risk assessment, policy development, and training programs. We’ll also delve into the challenges they face, such as navigating evolving regulations and fostering ethical behavior at all levels of the business.

What is a Compliance Officer?

A compliance officer ensures that businesses adhere to legal and regulatory requirements. They analyze laws and regulations relevant to the industry, keeping themselves updated with any changes.

By conducting internal audits and risk assessments, compliance officers identify areas where the business may fall short. They develop and implement policies and procedures to mitigate risks and ensure compliance.

Additionally, compliance officers educate employees on compliance matters, provide training sessions, and establish reporting mechanisms for potential violations.

Compliance Officer Role Overview

Before delving into the specific responsibilities of a compliance officer, it is essential to understand their overarching role within the business. Compliance officers serve as the guardians of legal and ethical integrity, ensuring that the business operates within the confines of applicable laws, regulations, and internal policies.

What Does a Compliance Officer Do?

Here are all the primary responsibilities compliance officers have in an organization:

Conduct risk assessments to identify potential compliance vulnerabilities and develop strategies to mitigate them.

Develop and implement comprehensive compliance programs that encompass policies, procedures, and controls.

Stay up to date with laws, regulations, and industry standards to ensure the business’s compliance.

Monitor and audit internal operations to identify and address any instances of non-compliance.

Work together with different departments to offer guidance and assistance in upholding compliance.

Taking allegations of misconduct seriously requires conducting in-depth investigations and taking decisive disciplinary measures if deemed necessary.

Design and deliver training programs to educate employees on compliance policies and procedures.

Establish effective reporting mechanisms that foster the identification and escalation of potential compliance matters.

Keep management and stakeholders informed about compliance issues, developments, and improvements.

Foster a culture of compliance and ethical behavior throughout the business.

The role of a compliance officer is multi-faceted, encompassing diverse responsibilities aimed at ensuring the business’s adherence to legal and ethical standards.

Overall, compliance officers play a vital role in safeguarding the business’s reputation and fostering its long-term success.

Compliance Officer Job Description

A compliance officer’s job description outlines the key responsibilities, qualifications, and skills required for this crucial role within the business. A well-crafted job description clearly defines the expectations and requirements, attracting candidates who can effectively navigate the complex landscape of legal and regulatory compliance.

Here is an example of what a comprehensive compliance officer job description might look like:

Compliance Officer Job Description Template:

We are seeking a responsible and skilled compliance officer who can oversee that our business operations align with legal mandates as well as ethical standards.

You would assume the pivotal task of creating effective measures for implementing successful compliance programs, which would include developing new policies and procedures plus upkeep of existing ones.

Responsibilities:

Develop and manage a robust compliance framework, including policies, guidelines, and control mechanisms, to ensure adherence to applicable laws, regulations, and industry standards.

Conduct regular risk assessments and audits to identify compliance gaps and recommend appropriate remedial actions.

Stay up to date with evolving regulatory requirements and industry best practices to proactively address compliance challenges and ensure the business’s ongoing compliance.

Collaborate with cross-functional teams to provide guidance and support in implementing compliance initiatives, training programs, and awareness campaigns.

Conduct internal investigations into compliance incidents, violations, or suspected unethical conduct, and recommend corrective measures.

Monitor and evaluate the effectiveness of the business’s compliance program, identify areas for improvement, and implement necessary enhancements.

Serve as a central point of contact for regulatory agencies, manage audits and inspections, and ensure timely and accurate responses to inquiries and requests for information.

Deliver comprehensive compliance training to employees, raise awareness of compliance obligations, and foster a culture of ethics and integrity throughout the business.

Requirements:

Bachelor’s degree in law, business administration, finance, or a related field.

Proven experience of at least 5 years in a compliance officer or similar role, preferably in the [industry or sector].

In-depth knowledge of relevant laws, regulations, and industry standards.

Strong analytical skills to assess risks, identify compliance gaps, and propose effective solutions.

Excellent communication and interpersonal skills to effectively engage with stakeholders at all levels of the business.

The detail-oriented mindset with the ability to interpret complex information and navigate ambiguity.

Professional certifications in compliance, such as [mention specific certifications if applicable], are desirable but not mandatory.

Types of Compliance Officers

The role of a compliance officer extends across various industries and sectors. Each with its specific regulatory landscape. As a result, there are multiple types of compliance officers, each focused on ensuring compliance within their respective domains.

Here are some of the common types of compliance officers:

Corporate Compliance Officer

A corporate compliance officer is responsible for overseeing and enforcing compliance with laws, regulations, and internal policies within a corporation. They work closely with management to develop and implement compliance programs tailored to the businesses specific needs.

Their role includes conducting risk assessments, designing compliance policies and procedures, providing training to employees, monitoring compliance, and responding to compliance-related issues or breaches.

Corporate compliance officers ensure that the company operates within legal and ethical boundaries, safeguarding its reputation and mitigating risks associated with non-compliance.

Healthcare Compliance Officer

Healthcare compliance officers play a critical role in ensuring that healthcare businesses comply with industry-specific regulations, such as HIPAA (Health Insurance Portability and Accountability Act) and Medicare guidelines.

They are responsible for developing and implementing compliance programs that address privacy, security, billing, and documentation requirements.

Healthcare compliance officers conduct audits, train employees on compliance matters, investigate potential violations, and work with regulatory agencies to maintain compliance. Their focus is to protect patient information, promote ethical practices, and maintain the integrity of healthcare operations.

Data Protection Compliance Officer

With the growing emphasis on data privacy and security, data protection compliance officers have become increasingly important. These professionals specialize in ensuring that businesses comply with data protection laws, such as the General Data Protection Regulation (GDPR) and other regional or industry-specific regulations.

They assess data privacy risks and develop data protection policies and procedures, including obtaining proper cookie consent, conducting audits, monitoring data handling practices, and providing guidance on data breach response and incident management.

Data protection compliance officers play a crucial role in safeguarding sensitive information, maintaining consumer trust, and avoiding legal and financial repercussions related to data breaches, while also ensuring adherence to relevant GRC frameworks.

Other Relevant Job Titles

Beyond the above mentioned types, there are several other compliance officer job titles that cater to specific industries or compliance domains.

Some examples include financial compliance officers, environmental compliance officers, regulatory compliance officers, ethics and compliance officer, and anti-money laundering (AML) compliance officers.

Each of these roles focuses on ensuring compliance with specific regulations, standards, or ethical guidelines relevant to their respective fields.

By understanding the various types of compliance officers, businesses can identify and hire professionals with the specialized knowledge and expertise necessary to navigate the unique compliance challenges within their industry or sector.

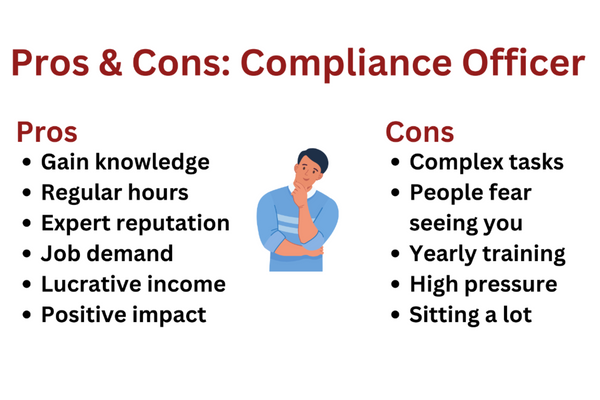

Pros & Cons Of Being a Compliance Officer

You might want to become a compliance officer if you’re all about following the law and assisting businesses with their varied compliance needs. You’ll become involved with a certain industry’s legal and regulatory obligations.

You should be aware of both the advantages and disadvantages of the profession before deciding if it is the one you want to pursue as a career.

Pros of Being a Compliance Officer

Even though the position of a compliance officer may not sound glamorous, there are several benefits.

Exposure to various regulations ‒ gain in-depth knowledge and understanding of diverse regulations and industry standards, which enhances their professional expertise and marketability.

You put in regular hours of work ‒ You’ll collaborate with others, monitor their progress, discuss documents, and more. This allows you to have regular work hours, avoiding late nights or early mornings.

Contributing to ethical practices ‒ play a crucial role in promoting a culture of ethics and integrity within businesses, making a positive impact on corporate conduct and reputation.

Weekends and holidays are your off days ‒ Due to the fact that none of the other employees will be working on weekends or holidays, you will be required to work on those days as well. It enables you to raise a family and have a respectable social life without constantly feeling like you are working.

Others believe you to be an “expert” ‒ As a compliance officer, you gain a reputation for high social standing. You can break the ice by discussing your daily activities, as many people are unfamiliar with your role. Additionally, colleagues seek your expertise for assistance with their duties.

Job stability and demand ‒ Compliance officers are in high demand due to increasing regulatory requirements across industries, providing job stability and potential career advancement opportunities.

Lucrative income ‒ A typical annual pay of around $71,000 is possible, according to the Bureau of Labor Statistics. You could even be able to make more money if you work for the federal or state governments.

You can work for various businesses ‒ Compliance officers are frequently employed by businesses because they help them pass all required inspections. Once you have experience, it will be simple for you to look for different employers in order to pursue greater pay and additional perks.

Continuous learning ‒ Compliance is an ever-evolving field requiring professionals to stay updated with new laws, regulations, and industry trends, providing ongoing opportunities for learning and professional development.

Cons of Being a Compliance Officer

Since being a compliance officer requires a specific personality, you should be aware of the drawbacks before deciding whether the stress and frustration are worth it.

Complexity and ambiguity ‒ They face complex regulatory landscapes, requiring them to interpret and apply regulations in practical business scenarios, often navigating through ambiguity and gray areas.

People hate to see you ‒ When someone uses the term “compliance officer,” there is typically a sense of fear. It is your obligation to let someone know what is wrong and what needs to be done to make it right if they are not abiding by the rules or the legal requirements of the work.

Some divisions might not respect you ‒ Certain departments may treat you rudely and hinder your duties due to their assumption of expertise in rules, legislation, and best practices. Dealing with this will cause significant stress, making it challenging to perform your work effectively.

A boatload of training ‒ To keep current on all of the most recent regulatory concerns in the field you work in, you will need to attend a large amount of training throughout the year. You must be the first to be informed of any changes so that you may hold others responsible.

Pressure and accountability ‒ They bear significant responsibility for ensuring adherence to regulations, which can result in high-pressure situations and accountability for compliance failures.

You’ll be in front of a computer a lot ‒ You’ll spend the majority of your working hours in front of a computer or tablet. You will therefore be exposed to light, which might cause headaches and eyestrain.

How to Be a Compliance Officer

Here are the steps and considerations involved in pursuing a career as a compliance officer, providing insights for individuals interested in entering this field.

Steps to Become a Compliance Officer

Assess career preferences ‒ Start by evaluating your interest in regulatory compliance and understanding the specific industry or sector that aligns with your career goals. Consider the regulatory landscape, the types of compliance roles available, and the industries that interest you the most.

Earn educational credentials ‒ Earn a bachelor’s degree in fields like law, business administration, finance, or a related discipline. Advanced degrees or certifications in compliance, such as CCEP or CRCM, may be required or preferred by some companies.

Gain work experience ‒ Seek entry-level positions in areas related to compliance or regulatory affairs. This can include roles in legal departments, risk management, internal audit, or compliance support functions. Internships or volunteer opportunities in compliance departments can also provide valuable hands-on experience.

Develop key skills ‒ Enhance your skill set to excel in the compliance field. Important skills include strong analytical abilities, attention to detail, excellent communication and interpersonal skills, problem-solving capabilities, and the ability to interpret and apply complex regulations in practical scenarios.

Stay informed and network ‒ Keep up-to-date with the latest regulatory developments, industry trends, and best practices in compliance. Attend conferences, seminars, and webinars related to compliance, and actively engage in networking opportunities to connect with professionals in the field.

Seek professional certifications ‒ Get certified in compliance through reputable organizations like SCCE or ICA to demonstrate your expertise and knowledge in the field.

Continual learning and growth ‒ Stay curious, continuously learn, and grow professionally in the ever-changing field of compliance. Invest in ongoing training, advanced certifications, and industry associations to expand your knowledge and stay ahead.

By following these steps and proactively building your knowledge, skills, and experience, you can pave the way for a successful career as a compliance officer.

How Long Does it Take to Become a Compliance Officer?

Becoming a compliance officer typically takes six to seven years of education and work experience. Typically, individuals start by obtaining a relevant bachelor’s degree, which takes around four years.

Gaining practical experience through entry-level positions or internships in areas related to compliance is essential, and usually takes two to three years to develop the necessary skills.

Additionally, ongoing professional development, including advanced certifications and staying updated with regulatory changes, is crucial for a successful career in compliance. While the exact timeline may vary, it generally takes a significant investment of time and effort to become a proficient compliance officer.

FAQs

What is the role of a compliance officer in a business?

Compliance officers ensure business adherence to laws, policies, and regulations. They develop programs, assess risks, monitor compliance, and provide guidance to employees.

How do I become a better compliance officer?

To improve as a compliance officer, you should continuously learn and develop professionally. Stay updated on regulations, attending pieces of training and conferences, network with peers, seek mentorship, engage with different departments, and foster a compliance culture.

What are the key responsibilities of a compliance officer?

Compliance officers handle diverse tasks tailored to the business and industry. They create policies, perform audits and investigations, monitor and report on compliance, provide training, and advise senior management.

What are the career prospects for compliance officers?

The demand for compliance officers is growing across industries due to increasing regulatory complexity and the emphasis on corporate governance and risk management.

Career prospects for compliance officers can vary based on factors such as experience, industry specialization, and professional qualifications.

However, common industries include the technology and healthcare sector.

Closing

After understanding the crucial role of a compliance officer in the business and the responsibilities associated with it, you might be wondering about the next steps to take. At Captain Compliance, we are here to help you navigate the path to becoming an effective compliance officer and further enhance your compliance career.

Captain Compliance can provide valuable guidance and recommendations regarding reputable institutions and certifications that can boost your credentials.