Updated March 21, 2024 Navigating the world of data privacy can be complex, particularly when understanding new abbreviations like PII and PCI. Discover the key differences between PII vs PCI here.

PII refers to information like consumers’ names and addresses, while PCI focuses on how businesses handle credit card transactions. Both are significant as they determine how data is collected, used, and stored within a business.

In this article, we will explore the differences between PII and PCI and more.

Let’s dive in!

Key Takeaways

PII refers to information such as consumer name and address. It is crucial for businesses to prioritize the security of this data.

PCI, on the other hand, entails regulations that businesses must adhere to when processing card payments. This includes details like the cardholder’s name and pin.

Captain Compliance serves as a resource for businesses, assisting them in complying with these regulations and safeguarding their data effectively. We possess expertise in ensuring that businesses carry out their operations correctly.

What is a PII?

What is a PII.jpg

Rob Wilkinson, Senior Business Development Manager at Data Protection People, says:

“Personally Identifiable Information (PII) is the distinct data that sets each of us apart and serves as a means of individual identification. This encompasses direct identifiers like passport information and quasi-identifiers such as race. The combination of quasi-identifiers with factors like date of birth can facilitate successful recognition and identification of an individual.”

PII can be classified into two categories: sensitive and non-sensitive.

Sensitive personal information includes details that, if exposed, could potentially cause harm, embarrassment, or unfair treatment to an individual.

Examples of sensitive PII include names combined with data like Social Security Numbers, driver’s license numbers, detailed financial information, and medical records. Mishandling information can lead to damage to businesses and legal consequences.

On the other hand, non-sensitive PII may not have an impact but still holds significant importance in the business world.

This category includes data like zip codes, gender, race, and date of birth. Although each piece of PII may seem harmless on its own when combined, it can form a profile of an individual. Businesses often utilize this type of data for purposes of targeted marketing strategies.

What is a PCI?

What is a PCI.jpg

Rob states:

“Payment Card Industry (PCI), on the other hand, refers to the data collected and transmitted during electronic payment transactions. When coupled with the Data Security Standard (DSS), it constitutes a critical set of security standards. PCI DSS is implemented to ensure that companies handling payment card information maintain a secure environment, thereby promoting compliance and safeguarding data integrity.”

Safeguarding these details is crucial because if they fall into the wrong hands, it could lead to fraud or other illicit activities.

There exists a set of guidelines known as the PCI Data Security Standard (PCI DSS), which outlines how businesses can ensure the safety of card information. It covers aspects like securing computer networks, protecting card data and assessing potential risks or threats.

For businesses, adhering to these rules is not just a necessity but also helps instill trust among consumers and partners.

Consumers are concerned about the security of their card information when they make purchases or payments. This is where PCI comes into play. It prioritizes and ensures the safety and protection of transactions.

Does your business process PCI? If so, you need to protect it properly. Get in touch with us to find out how you can ensure your business is compliant. Sensitive personal data, encompassing Personal Identifiable Information (PII), Personal Health Information (PHI), and Payment Card Industry (PCI) data, plays a crucial role in how organizations interact with and serve individuals. These distinct data types are pivotal in the realm of information governance, which involves adhering to stringent security protocols to safeguard sensitive customer information and maintain transparency regarding its utilization.

Organizations across various sectors routinely handle customer data, entrusting them with a significant responsibility. From processing credit card transactions for purchases, managing patient health records at healthcare facilities, to collecting personal details for marketing strategies, the onus is on these entities to ensure the utmost security of this data.

Here are key points on how information governance benefits your organization while ensuring data security:

Enhanced Data Utilization: Leveraging collected data—ranging from consumer interests and demographics to other aggregated information—enables targeted research and marketing initiatives.

Operational Efficiency: Efficient data collection and management streamline organizational operations and help in accurately determining costs.

Risk Minimization: Information governance frameworks aid in reducing the potential risks associated with handling sensitive data, thereby protecting against data breaches and cyber threats.

Compliance and Standards: Each category of sensitive data—PII, PHI, and PCI—is governed by specific compliance standards. These standards guide organizations in implementing robust security measures and best practices, ensuring that customer data is not only utilized effectively but also protected against unauthorized access.

Adhering to these compliance standards not only maximizes the benefits derived from customer data but also fortifies an organization’s defense against cyber threats. By implementing solid information governance policies, organizations can navigate the complexities of data protection while staying within legal and ethical boundaries, ultimately fostering a trust-based relationship with their customers.

Differences Between PII vs PCI

When it comes to dealing with business data, we often come across terms that are really important.

PII and PCI are two terms that hold a lot of significance. While both are crucial in their own ways, they have roles and guidelines. Let’s take a look at their importance individually and the main differences between them.

Definition

Personally Identifiable Information (PII) includes data that can be used to identify people. It includes details like a person’s name, address, phone number, email, and Social Security number. PII is what sets individuals apart from one another.

On the other hand, the Payment Card Industry (PCI) refers to a set of standards and guidelines that businesses must adhere to when processing card transactions.

This includes not the card number itself but associated personal information such as the cardholder’s name, the card’s expiration date, and the security code (CVV) located on the back of the card.

Uses

Personally identifiable information (PII) serves purposes such as verifying an individual’s identity and facilitating communication with consumers. It encompasses the data that businesses may utilize for sending newsletters, confirming accounts, or even checking individuals into hotels.

On the other hand, payment card industry (PCI) compliance primarily focuses on payment processing. Whenever someone employs a credit or debit card for a purchase, PCI regulations are implemented to ensure the safety and security of the transaction.

Regulations

Personally Identifiable Information (PII) is safeguarded by privacy regulations implemented worldwide.

Various global regulations, such as the GDPR in the EU HIPAA in the U.S., along with state laws like CCPA, require businesses to safeguard Personal Identifiable Information (PII). These regulations also mandate the handling and protection of data, including mandatory data breach notifications.

On the other hand, the Payment Card Industry (PCI) has its set of guidelines known as the PCI Data Security Standard (PCI DSS). The purpose of these guidelines is to guarantee the security of card details.

It is mandatory for businesses that process card payments to adhere to these rules not as an obligation but also because it is required by law.

Penalty for Non-Compliance

Non-compliance with PII protection laws can result in severe penalties, including heavy fines. For example, a company found to be non-compliant may face up to €20 million or 4% of global turnover under GDPR provisions.

For PCI DSS compliance breaches, the consequences can also be serious and damaging. Financial institutions being violated might impose hefty fines depending upon the severity of the data breach. Fines may reach up to $100,000/mo and increased transaction fees.

Apart from this, non-complying businesses could have their card processing privileges revoked by credit card companies such as Visa and Mastercard, which greatly challenges the ability of these entities to do business.

Similarities Between PII vs PCI

When it comes to business data, there are two aspects to consider: Personally Identifiable Information (PII) and Payment Card Industry (PCI) standards. Although they have their differences, they do have some similarities.

Both PII and PCI are essential in safeguarding information in today’s world, where data breaches and cyber threats are common. Here are the features of PII and PCI.

Security Measures

Personally identifiable information (PII) needs to be stored, transmitted, and processed securely. Therefore, businesses must have suitable security protocols in place to ensure PII’s confidentiality is maintained.

Similarly, for payment card industry compliance (PCI), appropriate measures like secure networks and systems are essential as per the PCI DSS guidelines. This includes encryption of data during transmission over public networks or storing sensitive customer information on a server with high-quality firewalls.

Targets of Cybersecurity Attacks

Because of the information they contain, both Personally Identifiable Information (PII) and Payment Card Industry (PCI) data are highly sought after by cybercriminals.

Hackers frequently attempt to exploit weaknesses in systems in order to gain access to this data. Whether it involves details or cardholder information, security breaches can result in financial losses and damage to a business’s reputation.

Risk Assessments

The significance of performing risk assessments is emphasized by both Personally Identifiable Information (PII) and compliance with the Payment Card Industry (PCI). It is crucial for businesses to consistently assess their systems and procedures in order to detect any vulnerabilities.

By areas of weakness, businesses can take measures to enhance their defenses and ensure adherence to data protection regulations.

Proper Disposal Practices

Safeguarding information during its usage and ensuring its disposal are both vital. Guidelines regarding Personally Identifiable Information (PII) and the Payment Card Industry (PCI) underscore the significance of securely disposing of data.

This can involve shredding documents or permanently erasing data in a secure manner to prevent any recovery.

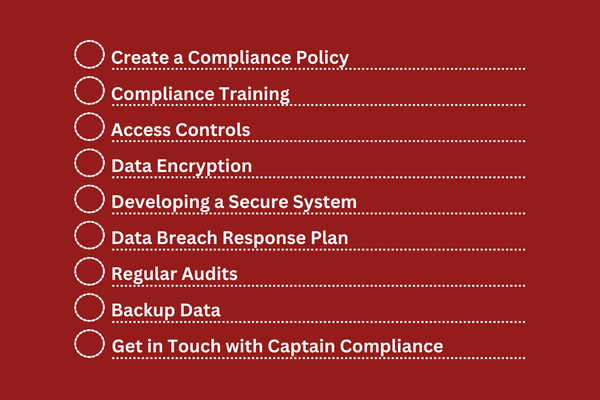

How to Ensure PII & PCI Remain Safe?

How to Ensure PII & PCI Remain Safe.png

Both Personally Identifiable Information (PII) and Payment Card Industry (PCI) data are valuable. If this data falls into the hands, it can lead to consequences such as fraudulent activities or identity theft.

As a result, businesses need to implement measures to protect this information. Now, let’s explore the recommended steps and best practices that can ensure the security of PII and PCI data.

Create a Compliance Policy

It is essential for every business to have a policy in place that clearly defines the rules and procedures for handling Identifiable Information (PII) and Payment Card Industry (PCI) data.

This policy should be effectively communicated to all employees, ensuring that everyone is aware of the methods for collecting, storing, and sharing sensitive data.

Compliance Training

It is essential for every employee to be well-versed in the regulations regarding Personally Identifiable Information (PII) and Payment Card Industry (PCI) compliance.

Conducting compliance training sessions ensures that all members of our team are equipped with the knowledge and skills to safeguard this sensitive data effectively.

Need help with securing PII and PCI in your business? Captain Compliance has your back. Get in touch for a free consultation today.

Access Controls

In a business setting, it’s not necessary for every person to have access to all data. Access controls play a role in ensuring that authorized individuals can view sensitive information such as Personally Identifiable Information (PII) and Payment Card Industry (PCI) data.

This can be achieved through the implementation of passwords or other effective security measures.

Data Encryption

Encryption functions as a mechanism that scrambles data in such a way that only individuals possessing the decryption key can decipher it.

By implementing encryption protocols for information (PII) and payment card industry (PCI) data, businesses can ensure its safety even in the face of attempted cyber theft.

Developing a Secure System

Computers and networks require specific security measures. This involves implementing firewalls, which act as barriers against hackers. Additionally, it is crucial to update our software to address any vulnerabilities that hackers could exploit.

Another effective measure is implementing two-factor authentication, which combines a password with a code sent to your phone, making it more challenging for individuals to gain access. Conducting system tests is also essential in identifying any weaknesses.

Educating everyone on practices, such as avoiding opening suspicious emails, plays a vital role in safeguarding our data from threats.

Data Breach Response Plan

Having a plan in place to address data breaches is crucial because it can have consequences for a business and its reputation. In the event of a breach, businesses must act swiftly to identify and contain it. It’s important to assess the scale of the breach, inform affected parties such as consumers, and ascertain if any legal obligations exist regarding reporting it.

Collaborating with security experts is also essential to understand the root cause of the breach and rectify any vulnerabilities.

Once the breach has been dealt with, businesses should conduct security reviews, provide staff training, and consider seeking assistance from security professionals. Additionally, maintaining monitoring of their systems is paramount to prevent future issues.

Regular Audits

Regular audits can aid in identifying any vulnerabilities within a system. Through conducting audits, businesses can ensure their adherence to regulations while maintaining the security of data.

Backup Data

Backups refer to copies of data. These copies guarantee that the information will remain accessible and intact even if the main data source is compromised.

By keeping backups, businesses can ensure their information is safe in case of computer crashes, accidental deletions, malware attacks, or natural disasters.

Scheduled backups, along with testing them, make it possible to quickly restore data with minimal downtime. This not only ensures a business’s operations continue smoothly but instills trust in clients and stakeholders by assuring them that their data is well protected.

How Can Captain Compliance Help?

As you navigate the landscape of safeguarding data, remember that you’re not alone. Captain Compliance is ready to assist you every step of the way.

Our extensive knowledge of data protection law guarantees that your business remains both compliant and secure.

Whether you aim to strengthen your data protection measures or seek advice on compliance, Captain Compliance can help. Don’t hesitate to get in touch with us. Contact us today for a free consultation on what your business should be doing for compliance.

FAQs

What are the Main Differences Between PII and PCI?

Personally Identifiable Information (PII) is a term that refers to data that can potentially reveal the identity of an individual. This includes details such as names, addresses, and Social Security numbers.

On the other hand, the Payment Card Industry (PCI) encompasses a set of standards and guidelines that businesses must follow when processing card transactions with the goal of protecting cardholder information.

If you want to learn more about the intricacies of PII and PCI, reach out to us today!

What data comes under PCI?

PCI (Payment Card Industry) data includes information related to credit and debit card transactions. This can include:

The full primary account number (PAN).

Any track data from the magnetic strip on a payment card, also known as ‘magnetic-stripe data.’

Three- or four-digit security codes printed on cards (CVV/ CVV2/CID).

PIN/PIN block: Personal Identification Numbers entered by customers.

It’s worth noting that under PCI standards, this sensitive authentication data must not be stored after authorization of the transaction is complete.

Why is Compliance with PII and PCI Standards Important?

It’s important to ensure compliance in order to protect information, build trust with consumers, and avoid consequences. Not meeting compliance standards can lead to data breaches, financial penalties, and damage to a business’s reputation.

Here’s our guide to PCI compliance services and everything you need to know

What Measures Can Businesses Take to Ensure Data Safety?

Businesses must make sure they put in place encryption protocols, conduct audits, create backups of their data control access to information, and have a well-rounded plan for dealing with data breaches.

Explore detailed measures for data protection in our GDPR guides!

How Often Should Businesses Review Their Data Protection Strategies?

Businesses should consider evaluating their data protection strategies on a basis, at least once a year or whenever significant changes occur in data protection regulations or business operations.

Learn more about optimizing data protection strategies in this article.

Is Account Number PCI or PII?

An account number is considered PII (Personally Identifiable Information) as it can be used to identify a specific individual. PCI refers to the Payment Card Industry, typically in the context of data security standards for handling card payments and preventing fraud.

Learn more about PII vs SPI in this article here!