Online data protection laws are becoming more stringent, and businesses have to be compliant with several regulations to avoid data breaches and fines. If your business deals with the payment card information of consumers, you’ll need PCI compliance services.

This will ensure your business is compliant with the Payment Card Information Digital Security Standard (PCI DSS) which sets the benchmark for payment card protection worldwide.

But what are the requirements of the PCI DSS, and how can you ensure PCI compliance? This article will cover the PCI compliance standards, why it’s important for businesses to follow, specific requirements for being PCI compliant, and more.

Let’s dive right in.

What is PCI Compliance?

What is PCI Compliance.png

In a nutshell, PCI compliance refers to compliance with the PCI DSS. This standard covers regulations required to protect cardholder information from data breaches, fraud, and other digital payment risks.

PCI compliance ensures that businesses that handle sensitive payment card information have effective security systems in place to avoid fraud and data loss. This applies to all companies who:

Process payment card data, such as third-party payment processing services.

Store payment card information, such as businesses with automatic payment renewal models.

Transmit sensitive payment card information, as most online retailers do.

PCI compliance covers policies, procedures, and awareness standards required by businesses in handling payment information. It also covers the IT security infrastructure required to enforce these policies.

Examples of PCI compliance processes include anti-malware installation, password protection systems, data access restrictions and updated documentation policies, amongst others.

These processes are crucial for being compliant, not only with PCI DSS, but with HIPPA regulations and other data privacy laws.

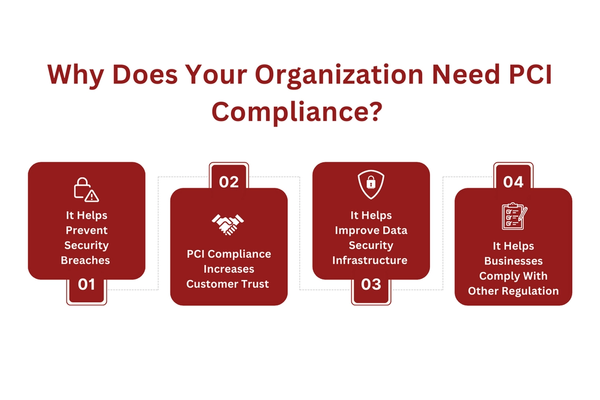

Why Does Your Organization Need PCI Compliance?

Why Does Your Organization Need PCI Compliance .png

If your business processes, transmits or stores payment card information, you’ll need to be compliant to use many payment card systems.

However, besides being a technical requirement, there are many other benefits to being PCI compliant. Being compliant with these standards gives your business credibility and can help you avoid data breaches.

Here are some reasons why you organization needs PCI compliance:

It Helps Prevent Security Breaches

One of the key factors of PCI compliance services is risk prevention. PCI DSS standards are designed to ensure businesses are protected against security breaches from malicious software and hackers.

If your business stores payment card information of hundreds or thousands of consumers, a security breach can cause enormous losses for your business. Worse, you’ll have to deal with additional fines and customer fallout afterwards.

PCI Compliance Increases Customer Trust

Following PCI compliance regulations will give your business more credibility with consumers. Surveys show that consumers are increasingly worried about their sensitive personal information when purchasing online.

Having PCI compliance can help establish consumer trust in your business and can help reduce the number of customers who hesitate to purchase due to credibility concerns.

It Helps Improve Data Security Infrastructure

As data theft techniques evolve, so do the data protection processes. PCI compliance services help businesses adopt better IT infrastructure in order to remain compliant. This encourages businesses to upgrade their systems and give importance to consumer data protection.

Furthermore, better IT infrastructure can make payment and data input procedures easier for consumers, which contributes to the ease of doing business.

It Helps Businesses Comply With Other Regulations

PCI DSS regulations are remarkably similar to many other data protection regulations like the CPA, GDPR and HIPPA regulations. While these regulations cover data protection on a larger scale, they place emphasis on sensitive data protection, such as consumer payment information.

So by using PCI compliance services, you’ll be taking another step towards financial compliance and total corporate compliance. However, always remember that PCI compliance should be part of your data protection framework, but not the entirety of it.

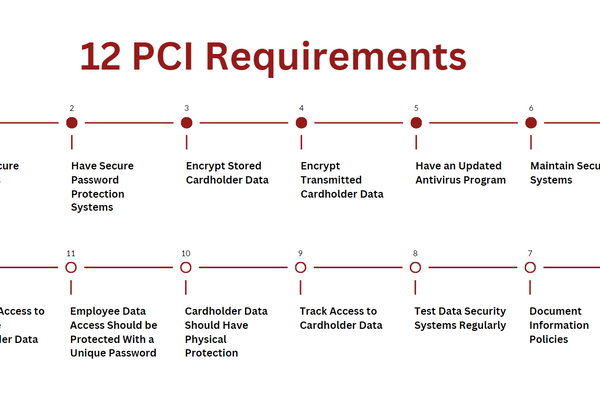

12 PCI Requirements

12 pci requirements.png

The PCI compliance framework is based on 12 requirements. These requirements cover data protection and security, risk control, vulnerability management, and information policy. For your business to be PCI compliant, it should have the following requirements:

1. Have Secure Firewalls

Firewalls are the first line of defense in any data security system. They prevent attempts to access data from outside the organization and can protect cardholder data. Having strong firewalls, maintaining them regularly and keeping them updated are key PCI requirements.

2. Have Secure Password Protection Systems

Secure password protection systems are essential in businesses that process and store payment card information. One PCI requirement is that businesses should have password difficulty requirements for card data and passwords should be updated regularly.

Similarly, businesses should not use generic passwords for modems, portals, and other devices involved in data processing. This precautionary measure is key to prevent the most common hacking attempts.

3. Encrypt Stored Cardholder Data

PCI compliance requires businesses to encrypt cardholder data before storing or transmitting it. The encrypted data is protected with double encryption and can only be accessed through encryption keys.

This prevents hackers from accessing sensitive consumer data, even if they gain access to the systems.

4. Encrypt Transmitted Cardholder Data

Like with stored cardholder data, businesses have to encrypt cardholder data when submitting it through public platforms. Even if the data is sent through third-party payment processors, it has to be encrypted beforehand.

5. Have an Updated Antivirus Program

Having an updated antivirus program is a key requirement for most home PCs and businesses that deal with sensitive payment information should have more advanced antivirus software.

To be PCI compliant, you’ll have to update the antivirus software and other security programs regularly.

6. Maintain Secure Systems

While certain security software will have a direct impact on your business’s data security, regular updates should not be ignored.

Always treat simple Windows updates as important as critical antivirus updates. This applies to all systems and programs linked to sensitive consumer data.

7. Restrict Access to Sensitive Cardholder Data

A key PCI requirement regarding cardholder data collection is that businesses should only collect data on a “need to know” basis. Similarly, access should only be given to staff that actually need to process or use the data.

8. Employee Data Access Should be Protected With a Unique Password

In most businesses, some employees will undoubtedly have access to cardholder data. However, these employees should have encrypted access portals with unique passwords so that culprits can be identified if data is leaked.

9. Cardholder Data Should Have Physical Protection

Cardholder data that’s stored on physical devices such as computer drives or USBs should be protected through physical restriction to the data.

In case data is compromised due to the businesses failure to restrict physical access to data storage systems, the business may be liable to a hefty fine.

10. Track Access to Cardholder Data

For businesses that store and transmit cardholder data, the PCI requirements are that the business has to create a record for each time the data was accessed. This limits internal fraud and can help authorities track data breaches.

11. Test Data Security Systems Regularly

Another preventive PCI requirement for protecting cardholder data is regular system vulnerability tests. Regular testing helps businesses identify risks before they result in breaches. Vulnerability testing should involve both human and systematic error assessment.

12. Document Information Policies

Lastly, organizations will have to document everything from security policies to employee access to cardholder data and even access logs. This isn’t only a PCI requirement as many other data protection regulations require proper information flow documentation.

Best PCI Compliance Services

PCI compliance services are designed to ensure your business is compliant with the 12 PCI requirements. Having PCI DSS compliance solutions can help you avoid issues with payment operators, credit card companies and third-party payment systems.

Here are some of the best PCI DSS compliance services to consider for your business:

SolarWinds Access Rights Manager

SolarWinds access rights manager is designed to monitor active directory implementations and can help restrict access to sensitive card data. This is a key tool to help prevent internal data leakage and card fraud.

ManageEngine Event Log Analyzer

This software comes with built-in PCI DSS compliance audits and can streamline the process of event log management. You can also use it to streamline HIPPA auditing.

MalwareBytes Anti-Malware Protection

MalwareBytes is one of the best anti-malware systems designed to protect businesses against complex hacking attempts. It’s designed to scan your system for potential security flaws and implement patches accordingly.

SecureFrame

SecureFrame is a comprehensive compliance solution that allows you to remain PCI DSS compliant by processing and managing payment card information.

It can also be used for compliance with other data protection regulations such as HIPPA and SOC 2 regulations. If you’re looking for an automated PCI compliance solution, SecureFrame is ideal.

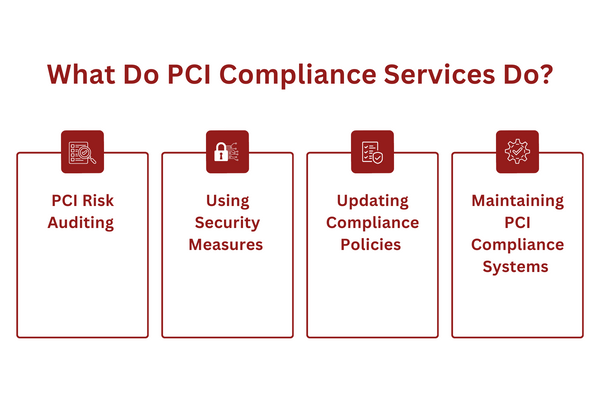

What Do PCI Compliance Services Do?

What Do PCI Compliance Services Do.png

PCI compliances services help businesses fulfill the PCI DSS requirements. These services help automate compliance events such as security management, log analyzers, updating PCI policies, and more.

Some PCI compliance services help businesses comply with specific PCI requirements, while other software options provide complete compliance solutions.

Some of the primary functions of PCI compliance services include:

PCI Risk Auditing

PCI solutions can help with security analysis and risk auditing to determine how compliant a business is with PCI DSS. This includes a complete digital audit that can help identify risks which businesses can then rectify.

Implementing Security Measures

Since payment card data protection is a core part of PCI compliance, most businesses need a solution for data security. These include anti-malware solutions, log analyzers, access restriction software, password protection tools, and other security software and measures.

Updating Compliance Policies

Since compliance requirements change with the development of new technologies, businesses that don’t adapt may become non-compliant. PCI compliance services help businesses stay compliant by regularly updating compliance framework and policies.

Maintaining PCI Compliance Systems

Like with other compliance systems, PCI compliance is an ongoing process that needs well-maintained systems. PCI system maintenance includes analyzing performance logs and log access, updating security software and firewalls, and properly handling security incidents.

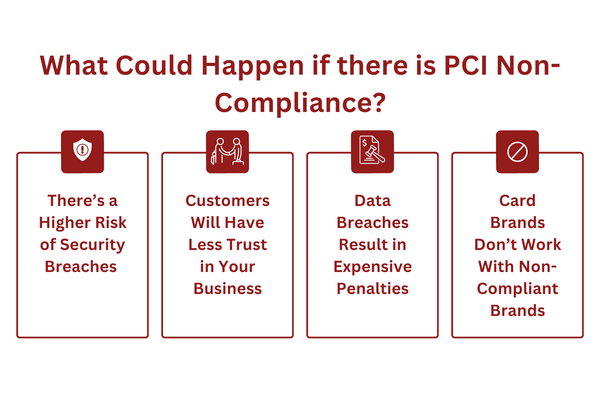

What Could Happen if there is PCI Non-Compliance?

What Could Happen if there is PCI Non-Compliance.png

PCI non-compliance can be costly, especially if your business stores sensitive payment card information.

In most cases, Visa, Amex, and other vendors won’t work with businesses that are non-compliant. However, being non-compliant can also increase the risk of data loss, which could lead to hefty fines.

Here’s what may happen if a business is PCI non-compliant:

There’s a Higher Risk of Security Breaches

PCI DSS standards are designed to protect consumer data and a key requirement is strong security systems. If your business isn’t compliant with PCI guidelines, it may have a higher risk of security breaches.

Breaches not only compromises consumer data, but they may result in business data being leaked as well.

Customers Will Have Less Trust in Your Business

PCI compliance helps customers know that their payment card information is safe with your business. Many people will avoid buying from non-compliant businesses due to a higher risk of data loss.

On the other hand, having PCI compliance can help new businesses establish trust with consumers, especially with regards to payment processes.

Data Breaches Result in Expensive Penalties

If your business stores and transmits sensitive information, such as payment card data, it’s also responsible for protecting that data. In the case of data breaches, non-compliant businesses are generally hit with higher fines.

Considering that a single breach can compromise the data of thousands of consumers, this can translate to fines of several million!

Card Brands Don’t Work With Non-Compliant Brands

If your business accepts consumer payment card information, it has to follow the regulations of the card brands. Most card brands, like Visa, won’t work with businesses that are PCI non-compliant.

However, even if you are partially compliant, you may get hit with fines for every violation of PCI DSS requirements. Continuous violations may even result in card brands refusing to work with the business.

FAQs

Is PCI Compliance Compulsory?

PCI compliance is not a legal requirement, but it’s compulsory if you want to work with most major card brands. Card companies may even fine you for every instance of PCI non-compliance.

What Happens if I’m PCI Non-Compliant?

You may not be able to accept payment from most card brands if your business is PCI non-compliant. However, non-compliance also leaves your business at risk from data breaches, which could result in a damaged reputation and hefty fines.

Do I Need to Be PCI Compliant?

If your business deals with payment card information, you’ll need to be PCI compliant. This applies for all businesses involved in transmitting, storing and processing payment card information.

Do I Have to Pay a PCI Compliance Fee?

Most major vendors will charge a minor fee for PCI compliance. However, this fee is compulsory as the merchants are responsible for enforcing PCI compliance.

How Do You Know If You Are PCI Compliant?

You’ll have to undergo regular audits tracking the payment card information flow in your company to determine whether it’s PCI compliant or not. However, most businesses have external auditing firms do these audits for transparency.

Final Thoughts

PCI compliance is crucial for businesses that deal with payment card information. However, it’s an ongoing process, and failing to update your security systems can result in fines and a damaged reputation.