Navigating Indonesia’s data localization landscape is essential for businesses in today’s digital economy. This article focuses on Indonesia’s PDP law.

We will discuss data localization, how it affects your business, and the steps you must follow for compliance. If you’re a business professional, this guide can help you understand Indonesia’s data protection rules.

Let’s dive into the world of Indonesian data localization and unlock the secrets to successful compliance.

Key Takeaways

Businesses should study Indonesia’s PDP Law to ensure thorough compliance in data handling and processing.

For businesses, it is crucial to recognize the specific requirements of data localization in sectors like finance and the need for secure data transfer across borders, adjusting business strategies accordingly.

Businesses must stay informed of the severe penalties for non-compliance to avoid fines and legal trouble.

Indonesia PDP Law Explained

Indonesia PDP Law Explained.jpg

Indonesia’s Personal Data Protection (PDP) Law, enacted on October 17, 2022, marked a significant step in the nation’s data protection regime. The PDP Law follows global standards and is similar to the EU’s GDPR, as it has many of the same regulations. Indonesia’s data protection was scattered over 30 laws and regulations before this.

The guidelines have rules for handling personal information, protecting rights, and managing data. Key features of the PDP Law include:

Broad Application: The law applies to both individuals and organizations processing personal data within Indonesia and has an extensive extraterritorial scope, affecting entities outside Indonesia if their activities have legal consequences in the country or involve Indonesian citizens.

Data Processing Principles: The Indonesian PDP Law aligns with international standards like the EU’s GDPR, emphasizing transparent, lawful data processing, accuracy, security, and detailed record-keeping. It upholds principles of data integrity and confidentiality, mirroring global data protection norms.

Consent and Data Subject Rights: It must be clear, informed, and specific to the purpose of data processing. The law gives people rights over their data, like access, correction, and being forgotten.

Cross-Border Data Transfers: The PDP Law deals with cross border data transfer. It requires good protection in the receiving country or consent from the person whose data is being sent.

Enforcement and Penalties: A tiered system of administrative, civil, and criminal penalties is set for non-compliance. The law created the Indonesian Data Protection Authority. The authority makes sure these rules are followed.

Transition Period: The Indonesian Personal Data Protection (PDP) Law, provides a two-year grace period for businesses to align their operations with the new regulations.

Who Must Follow Indonesia’s PDP?

Under Indonesia’s Personal Data Protection (PDP) Law, the following entities are required to comply:

All Persons and Businesses Processing Personal Data: This applies to people and businesses who process Indonesian citizen’s personal information, whether they are from there or not. If their data activities affect Indonesians, they must comply with Indonesian law.

Public Bodies and International Businesses: The PDP Law covers public bodies and international businesses that receive state funds. These entities perform core administrative functions and are recognized under international law.

Specific Sector Mandates: While the financial services sector is broadly exempt, there are strict controls on data flows, especially in banking and non-banking financial institutions. For example, Bank Indonesia and the Financial Services Authority have imposed localization mandates requiring consent for data transfer in these sectors.

The PDP Law is important for many different entities and businesses in Indonesia. Understanding and following it are necessary.

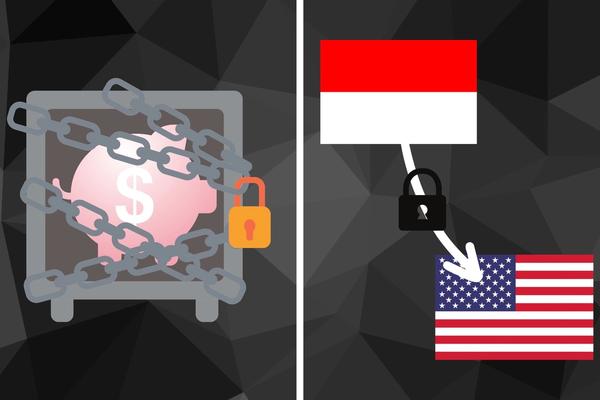

Does Indonesia Have a Data Localization Requirement?

Indonesia’s approach to data localization is nuanced. While earlier drafts of the PDP Law included strict data localization requirements, the final law focuses more on cross-border data transfer protections:

General Data Transfer Standards: The law mandates that personal data transferred internationally must be protected as per PDP Law standards, ensuring data safety across borders.

Sector-Specific Requirements: For public sector entities and the financial sector, Indonesia has implemented specific localization measures. For instance, financial institutions are restricted from transferring personal data to third parties without the consumer’s written consent, as per Regulation Number 1/POJK.07/2013.

Reduced Localization Mandates: The country has scaled back broader localization requirements in the final PDP Law, aiming for a balanced approach that facilitates data flow while ensuring protection.

Indonesia Data Localization Explained

Indonesia Data Localization Explained.jpg

Indonesia data localization refers to storing and processing certain types of data within the country’s borders. Indonesia data localization is primarily enforced in the public sector and financial services. For example, banks must keep personal financial data localized, complying with strict rules for data handling and transfer.

When transferring any personal data of Indonesian citizens internationally, businesses must ensure protection standards that align with Indonesia’s PDP Law. This includes safeguarding personal information from misuse or unauthorized access during the transfer process.

While the PDP Law has relaxed broader data localization demands, certain sensitive data types, like financial information, especially in banking and non-bank financial institutions, still require localization. This means such data should be stored and processed within Indonesia’s jurisdiction.

Regardless of whether data is localized or transferred, it must be handled securely, maintaining integrity and confidentiality. Businesses must implement robust security measures to protect data against breaches and unauthorized access.

In essence, data localization in Indonesia focuses on safeguarding sensitive information, particularly in sensitive sectors, while ensuring broader data protection for all personal data during cross-border transfers.

Exemptions to Indonesia Data Localization

The Indonesia data localization laws present varied implications for different business sectors. While the financial sector and public entities face stringent localization requirements, other businesses enjoy more flexibility in data handling.

Non-Financial Sector Businesses

While financial institutions face stringent Indonesian data localization requirements, other sectors don’t have similar mandates. Non-financial businesses are generally exempt from strict localization rules but must adhere to data protection standards during cross-border transfers.

Public Interest and Security

Certain data processing activities for national defense, law enforcement, security, or the public interest, as defined under the law, are exempt from the strict localization requirements.

How to Implement Indonesia Data Localization

How to Implement Indonesia Data Localization.png

Implementing Indonesia’s Data Localization involves several key steps to ensure compliance with the PDP Law. Businesses must understand and properly execute these measures for effective data management.

Ensure Recipient Country Data Protection

Businesses must rigorously check and confirm that any country receiving transferred data maintains data protection standards at par with Indonesia.

This step is crucial to ensure that data remains protected under similar privacy laws, especially when dealing with sensitive information.

If the country transferred to is not adequately protected, then ensure that you have adequate and binding security measures in place or if that is not possible, then to obtain consent from the data subject.

This consent should outline the purpose and scope of the data transfer, particularly in sectors handling sensitive data like finance.

Ensure Recipient Company Data Protection

Businesses should establish stringent security measures to protect personal data during transfer and storage. This includes employing encryption, access controls, and other data protection technologies, especially for data types that are more vulnerable or sensitive.

Ensure Storage of Data in Indonesia if Required

For sectors subject to strict localization rules, such as financial services, it is essential to store and process specific categories of personal data within Indonesia. This might include consumer financial information and transaction records.

Train Your Team

Businesses should conduct comprehensive training programs for their staff, focusing on the requirements of the PDP Law. This training should cover how to handle personal data securely, understand consent protocols, and the nuances of data transfer and localization rules.

You should have a data protection officer to enforce this training and to look over compliance measures as a whole, but there is an even better alternative that we’ll cover right now.

Partner with Captain Compliance

Partnering with Captain Compliance provides a comprehensive compliance framework and corporate compliance support to help businesses accurately follow Indonesia’s data rules.

We offer data protection compliance services and data compliance solutions, including compliance training and updates on new rules, ensuring your business stays ahead.

We also train employees on how to handle data safely and check for risks to stop any problems with following the law. This makes sure businesses are doing things right and keeping data secure.

Penalties for PDP Non-Compliance

In Indonesia, adherence to the Personal Data Protection (PDP) Law is enforced through a stringent system of penalties, highlighting the country’s commitment to data privacy and security.

Administrative Sanctions

The law’s specific administrative sanctions include issuing warning letters, suspending data processing activities, and mandating the deletion of personal data. Additionally, the law imposes administrative fines, potentially reaching up to 2% of a business’s annual revenue, although the precise calculation method for these fines is not clearly outlined.

This detailed understanding of the penalties is essential for businesses, as non-compliance can lead to significant operational disruptions and hefty financial consequences.

Criminal Penalties

Non-compliance can lead to imprisonment for four to six years and/or monetary penalties ranging from IDR 4 to 6 billion (approximately USD 285,000 to USD 430,000).

For corporations, penalties include monetary fines up to ten times the maximum individual amount. Additionally, there is a possibility of seizure of revenue/assets, suspension or permanent ban of business activities, license revocation, and business liquidation.

Closing

As you finish reading about Indonesia’s data laws, you might wonder what to do next for your business. This is where we, Captain Compliance, come in. We can help you understand these laws better and make sure your business follows them correctly.

Contact us for a tailored compliance plan and our compliance solutions, including outsource compliance services, to ensure your team is well-trained and your business data remains secure.

With our comprehensive compliance services, your business can handle data correctly, ensuring safety and legal adherence.

FAQs

What Entities Need to Comply with Indonesia’s PDP Law?

All businesses processing personal data within Indonesia and specific sectors like finance must comply.

Unsure about your compliance needs? Contact us for a personalized assessment.

How Does GDPR Data Localization Compare to Indonesia’s PDP Law?

While both GDPR and Indonesia’s PDP law emphasize data protection, there are key differences in their approaches to data localization.

To understand these differences and how they impact your business, especially if you operate both in the EU and Indonesia, read our detailed comparison here. Gain insights to navigate both sets of regulations effectively.

What Specific Data Types Require Localization in Indonesia?

In Indonesia, the financial and public sectors have strict rules for localizing certain data, like personal financial information, within the country.

If you’re in a sector with specific data localization needs, we can guide you on which data types to localize and how to comply with these regulations. Our team will make a detailed analysis tailored to your business.

What Penalties Exist for Non-Compliance with Indonesia’s PDP Law?

Failing to comply with Indonesia’s PDP Law can result in administrative fines of up to 2% of annual revenue, criminal charges with imprisonment for four to six years, and substantial monetary penalties ranging from IDR 4 to 6 billion (approximately USD 285,000 to USD 430,000).