The finance sector is often rife with deceitful practices. This is why, to ensure integrity in this fast-moving sector, we need to use financial services compliance software.

Bank regulatory compliance software solution provider

Bank regulatory compliance software is a critical tool for financial institutions navigating the complex web of regulations that govern their operations. These platforms are designed to help banks meet stringent requirements imposed by bodies such as the Federal Reserve, OCC (Office of the Comptroller of the Currency), FDIC (Federal Deposit Insurance Corporation), and FinCEN (Financial Crimes Enforcement Network). Key functions often include managing anti-money laundering (AML) and know-your-customer (KYC) processes, tracking transactions for suspicious activity, ensuring adherence to consumer protection laws, and facilitating accurate regulatory reporting. The software provides a centralized system for policy management, risk assessments, audit trails, and employee training, all aimed at preventing violations, reducing legal exposure, and maintaining the trust of customers and regulators.

The intersection of bank regulatory compliance software with data privacy software solutions, like those offered by our team of compliance experts here at CaptainCompliance.com, has become increasingly vital. While traditional bank compliance software focuses on financial regulations and transactional integrity, data privacy solutions concentrate on the lawful collection, use, storage, and protection of personal information. Financial institutions handle vast amounts of sensitive personal data, including financial records, contact information, and sometimes even biometric data, all of which fall under the purview of comprehensive data privacy laws like GDPR, CCPA, and emerging state-specific regulations. Data privacy software ensures that banks not only comply with financial regulations but also respect and protect customer data rights, manage consent effectively, and handle data subject requests (DSARs) transparently.

CaptainCompliance.com’s data privacy software complements traditional bank regulatory compliance by providing specialized tools to address the privacy-centric demands of the modern regulatory landscape. For instance, while a bank’s AML software might flag suspicious transactions, CaptainCompliance.com’s platform helps ensure that the collection of customer identification data for KYC purposes adheres to data minimization principles and that associated privacy notices are fully compliant with relevant privacy acts. Features such as automated consent management, data mapping to understand where personal data resides, and streamlined DSAR processing integrate seamlessly with broader compliance efforts, helping banks manage customer privacy requests efficiently and maintain detailed audit trails for regulatory scrutiny. This integrated approach allows financial institutions to achieve a holistic compliance posture, safeguarding both financial integrity and consumer privacy.

What is Financial Compliance?

Financial compliance is the governance and prosecution of the laws and regulations in the financial sector.

This covers a wide range of rules, regulations, and standards that ensure individuals and businesses follow the legal and ethical practices in the financial industry.

In the United States, financial compliance is regulated by these institutions primarily:

The Federal Reserve

Federal Deposit Insurance Corporation (FDIC)

Securities and Exchange Commission (SEC)

Consumer Financial Protection Bureau (CFPB)

State Regulatory Agencies

On the other hand, in other countries, such as the UK, the main regulatory body for ensuring financial compliance is the Financial Conduct Authority (FCA).

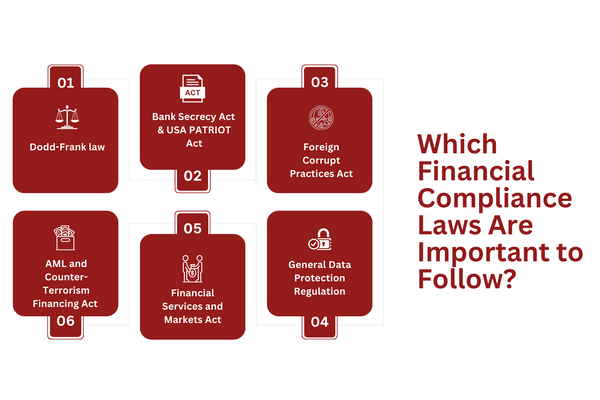

Which Financial Compliance Laws Are Important to Follow?

The financial sector itself includes banks and other financial institutions, insurance companies, capital markets, payment systems and services, FinTech, regulatory bodies, investment management, and more. There are many national and state-level compliance requirements.

Because of this, one financial law simply can’t cover all of these.

In the US, for instance, some important financial compliance laws include:

Dodd-Frank Wall Street Reform

The Dodd-Frank law came as a response to the 2008 financial crisis and was enacted in 2010. Its main goal was to further strengthen the oversight of financial institutions, and it created the Consumer Financial Protection Bureau (CFPB), among other things.

Bank Secrecy Act (BSA) & USA PATRIOT Act

The BSA was passed in 1970, and under it, financial institutions became obligated to keep records of cash transactions over $10,000 in a single business day.

Furthermore, BSA requires financial institutions to carry out Anti-Money Laundering (AML) programs and to report any suspicious activities that could lead to money laundering and terrorist financing.

Speaking of terrorist financing, following the 2001’s 9/11 attacks, USA PATRIOT Act further strengthened the AML measures and expanded the scope of BSA.

Foreign Corrupt Practices Act (FCPA)

The main goal of the 1977’s FCPA is to repel global corruption and ensure a fair business arena.

To achieve this, the FCPA prohibits US businesses from employing any corrupt practices, such as bribery, when conducting business abroad.

In addition to the US laws, other countries also have financial compliance laws similar to this.

General Data Protection Regulation (GDPR)

The EU’s GDPR covers the collection, processing, and storage of personal data, including financial data, for any businesses dealing with people in the European Union. This is a universal compliance framework that any business should follow.

Financial Services and Markets Act (FSMA)

The UK’s FSMA was enacted in 2000 with the idea to create a regulatory framework for UK’s financial services, better protecting consumers, ensuring market integrity, and overall increasing confidence in the UK’s financial sector.

Anti-Money Laundering and Counter-Terrorism Financing Act (AML/CTF)

Australia’s AML/CTF Act of 2006 requires banks, financial, and gambling services to create and deploy measures to detect and prevent money laundering and terrorist financing activities.

In addition to laws, businesses need to follow certain compliance frameworks. These serve as guidelines and merge regulations and mandates relevant to your business into a single framework.

What Do Financial Services Compliance Software Do?

Financial services compliance software helps financial institutions to successfully comply with relevant laws, regulations, and standards in their industry.

This software offers automated reports, which detail a wide variety of activities.

This type of software can also monitor and detect potential regulatory violations, alert the appropriate personnel or managers when one is detected, analyze financial data in real-time to identify risky investments and potential discrepancies, track audit logs, and maintain records of the company’s transactions.

Such software is also sometimes called compliance solutions or regulatory compliance software.

Best Financial Services Compliance Software

As each business has unique compliance requirements, choosing the best financial services compliance software isn’t the most straightforward.

Instead, it must include a careful assessment of the risks and goals of your particular business.

Here is a list of the best financial compliance solutions:

1. Captain Compliance

Captain Compliance provides a wide range of compliance solutions for businesses of all sizes and types, including financial compliance. In addition to financial compliance, we offer GDPR, CCPA/CPRA, DPIA, DSAR, and HIPAA compliance.

Our team of compliance experts helps firms build trust with consumers, foster a transparent culture, mitigate legal liability, enhance reputation and brand value, and safeguard financial system stability.

With the help of Captain Compliance, financial services will be better able to navigate and adhere to important security, privacy, antitrust and anti-money laundering (AML) laws.

2. Acuity

Acuity is an industry leader in identifying fraudulent and criminal activities and protecting business reputations thanks to data collected from over 750,000 financial institutions worldwide.

3. Zycus

Zycus Financial Compliance & Audit Control has over 20 years of experience helping small businesses improve compliance and minimize risks.

Powered by Merlin AI, Zycys’s software can address business sourcing & procurement, enterprise contact management (ECM), and accounts payables. Its financial software provides a clear view of the business processes.

4. Tyler Technologies

As the largest software & management solution provider in the US public sector, Tyler Technologies offers the Tyler Financial Regulatory Compliance (FRC) software that covers financial compliance from application to enforcement.

Their solution can be customized to work with different financial bodies, including holding companies, mortgage loan brokers, savings banks, and more.

5. Compliance.AI

With the help of machine learning, Compliance.AI offers regulatory change management solutions and tools for banking, financial, and insurance services and assists them in minimizing costs and risks.

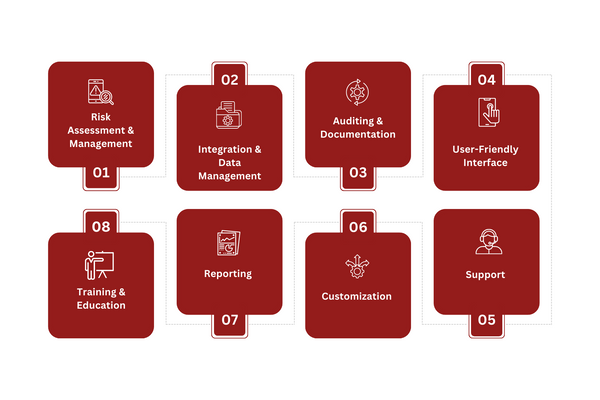

What to Look for in Financial Services Compliance Software?

Selecting a specific compliance software for financial services will depend on the unique requirements of your business. In general, here are some important factors to look for:

1. Risk Assessment & Management

Another factor to look for in financial compliance software for financial services is its ability to identify, assess and mitigate compliance risks.

2. Integration & Data Management

Even the best compliance software will prove useless if you’re unable to integrate it with your current systems and streamline data flows. This is especially important when it comes to data management and data privacy regulation compliance.

3. Auditing & Documentation

Every financial activity needs to be audited and documented. With compliance software, you will be able to keep a record of such activities and prepare for auditing by institutions that manage the financial sector.

4. User-Friendly Interface

Having a user-friendly interface that allows for easy navigation and a good user experience is vital for any software and especially for financial compliance software. Having a hard-to-use interface could lead to misreading or not implementing certain things.

5. Support

The financial compliance service software should also provide adequate support service, including updates and bug fixes. Along with this, you should also be aware of how fast the vendor is responding, and it’s reliability and overall reputation.

6. Customization

Again, with the unique requirements of every business, you should be able to customize your chosen compliance software to what your business needs and in a manner that allows you to scale up or down as needed.

7. Reporting

Next, the compliance software for financial services should offer to report functionalities that will allow you to track all the important activities relevant to your business, create compliance reports, and more.

8. Training & Education

One often neglected aspect of outsourcing compliance services is the training and education of your workforce.

While this will probably cost your business more in the short term, in the long term, it’s much better to facilitate a culture of compliance within your organization, and a solution that provides training modules and resources doesn’t ever hurt.

How to Implement Financial Services Compliance Software?

Implementing financial services compliance software in your business is fairly simple, but you need to do it right to avoid any complications.

Here are the top 10 steps that will help you put the software into action:

Identify your compliance needs.

Define your scope and objectives (reducing compliance risks, improving compliance responsiveness, etc.)

Choose the right compliance software based on your scope and objectives.

Prepare compliance data for migration to the new software.

Customize the software according to your business’s specific compliance needs and risks.

Ensure all the employees involved in compliance can use the compliance software adequately and that all employees can use the training. In this step, you should also facilitate the adoption of the software by highlighting its value for your organization.

Test and validate the software through different scenarios and workflows to see if it truly meets your compliance needs.

The implementation process doesn’t end with a “last” step. Instead, this final step, which is monitoring the performance of the compliance software, should be something that you do continuously, with periodic reviews of the software to ensure that it remains aligned with your compliance requirements as you grow.

FAQs

What is Financial Compliance Software?

Financial compliance software (regulatory compliance software) is software that is designed and developed to help financial institutions such as banks in complying with the relevant laws, regulations, and industry standards.

What is an Example of Financial Compliance?

Financial compliance includes many different areas, each handling a different thing. One example of financial compliance would be Anti-Money Laundering (AML), which aims to prevent money laundering and terrorism financing by detecting and reporting suspicious financial activities.

Is SAP a Financial Software?

Systems, Applications, Products (SAP) has a wide product portfolio, which includes financial software and tools designed to help firms manage their financial processes. Financial products under the SAP umbrella include:

SAP Financial Accounting

SAP Treasury and Risk Management

SAP Profitability and Cost Management

SAP Financial Closing Cockpit

Closing

With the ever-evolving regulatory landscape, financial compliance service softwares have become a necessity for businesses in the finance sector.

Financial services compliance software like Captain Compliance can help you better navigate the complex and constantly evolving field of compliance regulations and requirements.