For the rest of this year, financial services firms should prepare for several significant compliance updates:

- CFPB’s Open Banking Rule: This proposed rule will require financial institutions to provide consumers and authorized third parties with access to financial data. Key specifications include limitations on third-party data usage, the right for consumers to revoke data access, and standardized, secure data transfers. This rule aims to enhance consumer data rights and facilitate easier switching between financial service providers.

- Operational Resilience Requirements: Firms operating in the UK must adhere to new operational resilience rules. These rules require firms to identify and map critical business services, set impact tolerances for disruptions, and invest in resilience measures. This is crucial for maintaining stability and protecting consumers from potential operational disruptions.

These updates reflect a broader trend towards enhancing consumer rights, data security, and operational stability in the financial services sector. Firms should closely monitor these developments to ensure compliance and avoid potential penalties.

Financial services compliance is a critical aspect of the finance industry, ensuring that businesses adhere to regulatory frameworks and meet legal obligations.

Whether you’re a financial institution, a professional in the field, or an individual seeking to understand the compliance landscape, this guide will equip you with the knowledge to navigate this complex terrain effectively.

In this comprehensive guide, we’ll explore the complex realm of compliance in the financial services industry, covering its fundamental principles, regulatory obligations, and industry best practices.

Let’s dive in!

What is Compliance in Financial Services?

Financial services compliance governs the activities of finance businesses by enforcing rules, regulations, and ethical practices. It ensures adherence to legal requirements, and business standards, and promotes transparency, consumer protection, and financial system integrity.

It helps businesses navigate regulations, mitigate compliance risks, and covers areas like Anti Money Laundering (AML), Know Your Client (KYC), data protection, consumer rights, and market conduct. Its goal is to safeguard the interests of consumers and businesses, fostering trust and stability in the industry.

Financial services compliance is crucial for businesses in the sector. It ensures ethical operations, sound risk management, and upholds integrity. Non-compliance can lead to penalties, reputational damage, and loss of consumer trust.

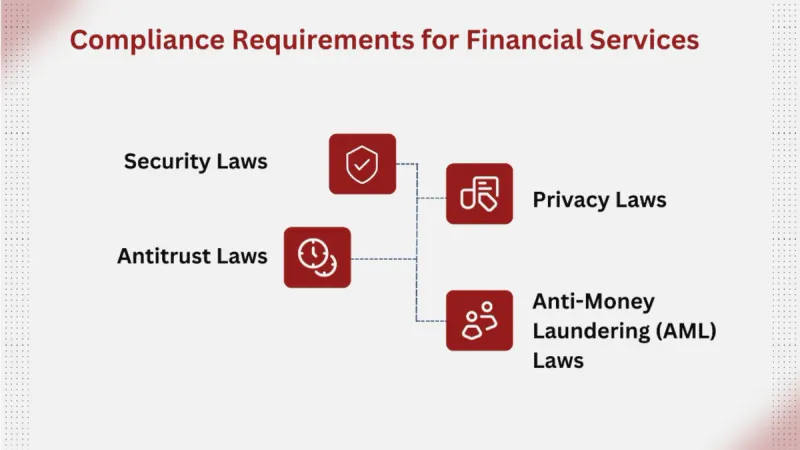

Compliance Requirements for Financial Services

Compliance requirements for financial services are essential to ensure the integrity and stability of the industry. In an ever-evolving regulatory landscape, financial institutions and businesses must navigate a complex web of rules and guidelines.

Failure to meet these requirements can result in severe consequences, including financial penalties, legal actions, and reputational damage. Here are the obligations of compliance that financial services businesses must prioritize to operate within legal parameters and uphold consumer trust:

Security Laws

Security laws play a crucial role in the financial services industry, aiming to safeguard sensitive data, protect against cyber threats, and promote secure transactions. Financial institutions are often required to implement robust security measures, such as encryption protocols, secure data storage, and access controls.

Compliance with security laws helps mitigate the risk of data breaches and unauthorized access, ensuring the confidentiality, corporate compliance, integrity, and availability of sensitive financial information.

Privacy Laws

Privacy laws, such as the GDPR and other regional or national regulations, dictate how businesses handle and protect consumer data. Businesses in the financial services sector must adhere to strict guidelines concerning data collection, processing, storage, and sharing.

Compliance with privacy laws involves obtaining informed consent, including cookie consent, providing transparent privacy policies, and implementing measures to safeguard personal information. By prioritizing privacy compliance, financial institutions can establish trust with consumers and demonstrate their commitment to data protection.

Antitrust Laws

Antitrust laws aim to prevent anti-competitive practices and maintain fair competition within the financial services industry. These regulations prohibit monopolistic behavior, price fixing, market allocation, and other activities that may stifle competition or harm consumers.

Compliance with antitrust laws requires businesses to maintain fair pricing structures, avoid anti-competitive agreements, and refrain from engaging in practices that restrict market access or limit consumer choice.

Anti-Money Laundering (AML) Laws

AML laws combat illicit financial activities like money laundering and terrorist financing. Financial businesses must establish comprehensive AML programs, including due diligence, monitoring, reporting, and internal controls.

Compliance is crucial to prevent misuse of the financial system and maintain industry integrity. Businesses should stay updated on regulations and establish tailored compliance programs.

Why is Compliance Important in Financial Services?

Compliance holds paramount importance in the financial services industry, serving as a cornerstone for sustainable growth, consumer trust, and regulatory adherence. Financial institutions and businesses must recognize the significance of compliance as a strategic imperative.

Here are some of the key reasons why compliance is crucial in financial services and the various benefits it brings to businesses and consumers alike.

Building Trust for Consumers

Compliance plays a vital role in building and maintaining trust with consumers. By adhering to regulatory requirements and industry standards, businesses in the financial services sector demonstrate their commitment to ethical practices, consumer protection, and the overall well-being of their clients.

When consumers have confidence in a business’s compliance practices, they are more likely to entrust their financial transactions and sensitive information, leading to stronger consumer relationships and long-term loyalty.

Fostering a Transparent Culture

Compliance promotes a culture of transparency within businesses operating in the financial services sector. By implementing robust compliance processes and practices, businesses can ensure that their operations are conducted in a transparent manner, leaving no room for hidden agendas, unethical behavior, or conflicts of interest.

A transparent culture not only builds trust with consumers but also fosters a healthy work environment, where employees understand the importance of compliance and adhere to ethical standards.

Mitigating Legal Liability

Compliance helps businesses in the financial services sector mitigate legal liability and avoid potential legal consequences. By staying abreast of regulatory requirements, businesses can ensure that their operations are aligned with the law.

Compliance programs that include risk assessments, internal controls, and ongoing monitoring help identify and address potential compliance gaps, reducing the risk of regulatory violations, penalties, and legal actions.

Enhancing Reputation and Brand Value

Compliance efforts contribute significantly to the reputation and brand value of businesses in the financial services sector. Businesses that prioritize compliance are seen as trustworthy, reliable, and ethical entities within the industry.

A strong reputation for compliance attracts consumers, investors, and business partners, leading to increased market credibility and potential growth opportunities. Moreover, a positive brand image built on compliance can help differentiate a financial services business from its competitors in a crowded marketplace.

Safeguarding Financial System Stability

Compliance is crucial for safeguarding the stability and integrity of the financial system as a whole. By adhering to regulatory requirements and preventing financial crimes, such as money laundering and fraud, businesses in the financial services sector contribute to a secure and resilient financial ecosystem.

Compliance measures protect the interests of not only individual businesses and consumers but also the overall health of the economy.

Organizations That Monitor Financial Compliance

Monitoring financial compliance is a dynamic and ongoing process that involves various organizations overseeing adherence to regulatory standards within the financial services industry.

These organizations play a crucial role in ensuring compliance with ever-evolving rules and regulations.

Here are the key entities responsible for monitoring financial compliance and maintaining the integrity of the financial system.

The Federal Reserve

In order to shape and regulate monetary policy across America effectively it falls to the hands of a key player: the Federal Reserve. With its duties including managing money supply while limiting inflation to within or under 2% as well as setting up federal funds rates ‒ its significance as a central bank cannot be denied.

To facilitate efficient operations at the Federal Reserve, a business comprising five individuals collectively known as the Board of Governors provides oversight.

Maintaining an independent Federal Reserve is a critical element in safeguarding its integrity against unwanted influence from other government branches like the President or Secretary of Treasury. Preserving this autonomy is essential for supporting smooth and efficient operations within our financial system.

Securities and Exchange Commission (SEC)

The SEC oversees US security exchanges, monitors markets for wrongdoing, and enforces regulations. Insider trading and fraudulent behavior are under scrutiny.

Publicly traded firms must file financial statements for transparency and informed investment decisions. Regulating rating agencies is crucial for a fair financial ecosystem, protecting against deceptive practices. This upholds investor confidence and safeguards, market participants.

Federal Deposit Insurance Corporation (FDIC)

The FDIC provides deposit insurance for banks and thrift institutions, assuring coverage up to $250,000. Its objective is to maintain public confidence in the US financial system.

It covers accounts like checking, savings, and CDs, and conducts bank examinations for safety and compliance. The FDIC also enforces consumer protection laws for banks’ adherence to regulations.

Primary Issues in Financial Compliance

Financial compliance encompasses a wide range of regulations and requirements that businesses in the financial services sector must adhere to.

However, there are specific primary issues that often pose significant challenges and require focused attention.

Here are the primary issues in financial compliance, examining key areas where businesses need to prioritize their efforts to ensure regulatory adherence and mitigate risks.

Data Security

Financial compliance procedures are crafted around securing confidential client details possessed by financial institutions from exploitation or infringement due to their delicate nature.

To effectively address the constant threat posed by malicious actors seeking unprotected personal information in your possession during business operations requires adherence to stringent guidelines on how you process their sensitive details when completing transactions if kept in storage.

Regulators such as Sarbanes Oxley (SOX), General Data Protection Regulation (GDPR), and Payment Card Industry Data Security Standard (PCI DSS) provide valuable guidance on how best to protect your client’s personal data.

Cybersecurity

The field of cybersecurity addresses more than just protecting personal information from malicious infiltration by attackers ‒ it includes thwarting such attacks in the first place and cultivating consumer faith in online transactions.

Threat actors typically go after business entities with databases containing sensitive information highlighting the importance of taking adequate security measures. The relevant legislation lays down guidelines to help companies meet their duties towards consumers’ well-being.

Effective measures include assessing potential risks against existing security protocols twice over at least once quickly defending privacy loss.

Consumer Laws

Businesses not only need to keep up with the constantly evolving financial compliance environment but also remain updated on consumer laws, such as the newly enacted Home Mortgage Disclosure Act (HMDA).

TechFunnel states that financial services compliance aims to protect consumer data and prevent unauthorized access to it. The primary objective is to enhance the accuracy and reliability of data reported by businesses in the financial services sector.

Employee Misconduct

Employee misconduct poses a significant compliance risk in the financial services industry. Violations of ethical standards, conflicts of interest, insider trading, and fraudulent activities can lead to severe legal and reputational consequences.

Compliance efforts must include robust internal controls, regular employee training on ethical conduct, clear policies and procedures, and strong whistleblower protection mechanisms. By promoting a culture of integrity and ethical behavior, businesses can mitigate the risk of employee misconduct and ensure compliance with regulations governing employee conduct.

Money Laundering

Money laundering is a crucial concern in financial compliance. Businesses in the financial sector must implement strong anti-money laundering (AML) programs to detect and prevent illicit fund origins. This includes consumer due diligence, transaction monitoring, and reporting suspicious activity.

By actively combating money laundering, financial institutions protect the integrity of the global financial system and prevent financial crimes. These compliance issues require ongoing attention and dedicated efforts from financial service businesses to maintain regulatory compliance, protect consumers, and mitigate risks.

How to be More Compliant in Financial Services

Achieving and maintaining compliance in the dynamic and highly regulated financial services industry is a complex endeavor. However, there are steps that businesses can take to enhance their compliance efforts and ensure adherence to legal and regulatory requirements.

Here are some key strategies and best practices to be more compliant in financial services, enabling businesses to navigate the compliance landscape effectively and mitigate potential risks.

Focus on Prevention

Prevention is a fundamental aspect of being more compliant in financial services. Businesses should prioritize proactive measures to identify and address compliance risks before they escalate.

This includes conducting regular risk assessments, establishing robust internal controls, and implementing policies and procedures that promote ethical conduct and regulatory compliance. By focusing on prevention, businesses can detect potential compliance issues early on, mitigate risks, and establish a culture of compliance throughout the business.

Establish a System for Monitoring Compliance

Having a systematic approach to monitoring compliance is essential to ensure ongoing adherence to regulations. This involves implementing effective monitoring and detection mechanisms to identify any deviations from compliance requirements.

Businesses should establish processes for regular internal audits, reviews, and assessments to assess compliance with relevant laws and regulations. By actively monitoring compliance, businesses can identify areas that require improvement, take corrective actions promptly, and demonstrate a commitment to maintaining compliance.

Maintain Proper Records

Maintaining accurate and comprehensive records is crucial for demonstrating compliance in financial services. Businesses should establish robust record-keeping practices that encompass relevant documents, transactions, policies, procedures, training records, and audit trails.

These records not only provide evidence of compliance but also support transparency, accountability, and regulatory reporting requirements. By maintaining proper records, businesses can effectively respond to regulatory inquiries, demonstrate due diligence, and ensure compliance with record-keeping obligations.

Stay Up to Date with New Regulations

The regulatory landscape is constantly evolving, with new laws, guidelines, and industry standards being introduced regularly. Staying up to date with these changes is vital for maintaining compliance.

Businesses should establish processes to monitor and track regulatory updates, assess their impact on operations, and implement necessary changes to ensure ongoing compliance.

Subscribing to regulatory newsletters, participating in industry forums, and engaging with compliance experts can help businesses stay informed and adapt their practices to meet new compliance requirements.

Consider Compliance in a Box

Compliance in a Box offers businesses an all-in-one compliance solution, handling legal obligations through services like monitoring, training, audits, and ongoing support. Outsourcing to Captain Compliance allows businesses to prioritize their core activities while benefiting from specialized expertise.

This approach enhances compliance efforts in the financial industry by emphasizing prevention, robust monitoring, record-keeping, staying updated with regulations, and leveraging comprehensive services for effective navigation of the compliance landscape.

FAQs

What is Financial Services Compliance?

Financial services compliance governs business activities in the finance sector, ensuring adherence to laws, standards, and ethical practices. It promotes transparency, consumer protection, and financial system integrity.

Why is Compliance Important in Financial Services?

Compliance is vital in financial services, building trust, promoting transparency, mitigating liability, enhancing reputation, and safeguarding the financial system.

What Are The Compliance Requirements for Financial Services?

Compliance requirements for financial services cover security, privacy, antitrust, and anti-money laundering (AML). This includes implementing security measures, handling consumer data responsibly, promoting fair competition, and establishing AML programs.

What Organizations Monitor Financial Compliance in The Financial Services Industry?

The Federal Reserve oversees monetary policy and financial system integrity. The SEC regulates security exchanges and enforces regulations. The FDIC provides deposit insurance and conducts bank examinations for safety and compliance.

How Can Businesses Be More Compliant in Financial Services?

Enhance compliance efforts with the prevention, systematic monitoring, record-keeping, staying updated on regulations, and utilizing services like Compliance in a Box for comprehensive compliance solutions.

Captain Compliance ensures businesses comply with financial regulations, reducing risks and building trust. With monitoring, training, audits, and ongoing support, we navigate this complex compliance landscape. Partner with us to focus on core activities while leveraging our expertise.

Contact Captain Compliance for comprehensive compliance in financial services, protecting consumers, enhancing reputation, and safeguarding your financial business.