Risk Management Frameworks are a way to increase the likelihood that you will avoid issues in the future. While there is no 100% foolproof solution having proper procedures and plans in place can decrease the probability of an issue in the future. Captain Compliance provides a guide for those looking for assistance or just would love to learn more.

Compliance is more important than ever because of many changing regulations and laws. Ensuring your business is in line with these standards is essential, and a compliance risk management framework is a must to maintain and preserve your compliance.

Managing your companies compliance risk has gotten so complicated in 2024 that you need a full time consultant or in house expert to help navigate all of the rules and regulations. One mistake can cost you thousands or even millions.

If you have a marketing and IT team who are quite certainly baffled and confused by obscure regulations and new legal frameworks that perplex everyone from the top down. With a lot of training and a proper risk management framework and the guide below you can be saved though.

This article will cover what a compliance risk framework can do for your business, industry-specific risks to compliance, and how to implement a framework into your business.

After reading, you will know how to monitor and successfully maintain your business’s compliance.

Let’s get started.

What is a Compliance Risk Management Framework?

A compliance risk management framework is the guidelines you put in place to ensure your business’s continued corporate compliance. This framework identifies and determines the threat level of perceived risks to the business’s compliance.

Unlike risk assessment frameworks that simply identify the risks, a risk management framework will also include preventative measures for identifying the risks.

Risk management frameworks include continuous monitoring and evaluation of your business’s protocols and compliance programs to determine if they meet regulation standards in place.

Risk management frameworks also identify the potential penalties your business could face if it does not comply with these regulations. A compliance risk management framework is essential for businesses in heavily regulated industries such as healthcare and financial services.

What Does a Compliance Risk Management Framework Do?

With increasing regulations in compliance frameworks, there is an increasing chance of non-compliance. A compliance risk management framework can help your business minimize this increasing risk by:

- Identifying potential risks: With a risk management framework in place, you will have continuous identification of potential threats to your business’s compliance. Awareness of these risks as early as possible is crucial for sufficient time for mitigation strategies.

- Continuously assessing and monitoring compliance: Your business will have the risk framework to reference. You can observe new and existing regulations and compare them to see how your business practices match up, then adjust for discrepancies.

- Implementing risk mitigation: With the ability to continuously monitor and identify potential risks to your business’s compliance, you can also implement preventative measures. After identifying the risk, you can take steps to control and minimize the potential of non-compliance by changing policy and procedures as necessary.

With a compliance risk management framework in place, your business can stay on top of potential risks and significantly reduce the possibility of penalties for non-compliance.

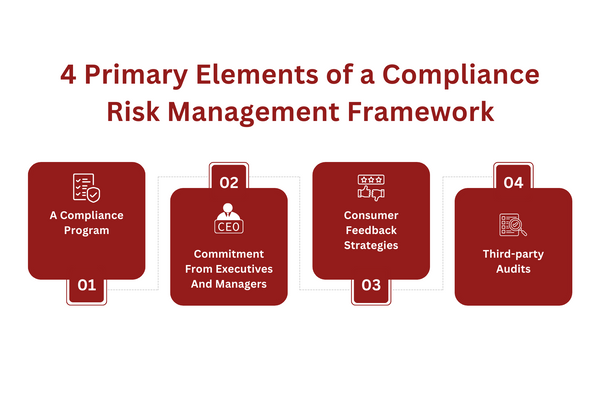

4 Primary Elements of a Compliance Risk Management Framework

Now that you know the significance of a compliance risk management framework, let’s go into the details of the framework’s structure.

To successfully implement a framework, you must understand the necessary foundational elements your business will need. Here are the four primary elements of compliance risk management:

A Compliance Program

To ensure a standard of compliance within your business, you must have a compliance program. A compliance risk management framework is centered around your business’s compliance program.

Your business’s compliance program will consist of procedures, protocols, policies, training, and assessments that create a compliance standard and confirm its continued success. You must train new employees to follow these compliance protocols and educate them on business policies.

Continued monitoring and assessing your compliance program to identify and mitigate risks is essential to a successful risk management framework.

Commitment From Executives And Managers

Upper-level management must enforce these policies and regulations to create a business-wide standard of compliance. Executives and managers should set an example of compliance and allocate the proper resources to create a successful compliance program.

Executives can create company policies and mission statements emphasizing compliance’s importance to the whole business. These policies should be a regular part of new and existing employee training.

Consumer Feedback Strategies

While ensuring your business’s compliance with industry regulations, providing a clear channel for consumer feedback is just as important.

Your business’s compliance risk management framework is centered around your business’s compliance to maintain a good reputation and ensure consumer satisfaction.

Popular methods of collecting consumer feedback are surveys, questionnaires, consumer help lines, and social media pages for your business.

Paying attention to your consumer’s satisfaction and feedback can help your business create a successful risk management framework.

Third-party Audits

After implementing a compliance risk management framework, regular audits are essential to measure its continued success. Audits should be done periodically to check for any errors in your compliance program and allow you to make the necessary corrections.

Hiring third-party services to conduct these audits to ensure fair and unbiased reviews is best. This continued monitoring and updating is crucial to your business’s continued compliance.

Industry-Specific Compliance Risks

Your business will face different risks depending on your industry. In addition, some industries are more heavily regulated than others.

It is important to recognize the industry-specific risks and implement the necessary protocols. You can utilize specialized compliance services to meet the compliance standards of your specific industry:

Banking

Any business in the banking industry is under heavy regulation from government agencies and legislation. Financial crimes seriously threaten consumers and businesses alike, so the regulations in the banking industry are stringent.

Several agencies oversee the banking industry, such as the U.S. Securities and Exchange Commission, Federal Deposit Insurance Corporation, and the Office of The Comptroller of The Currency. The risk of not complying with them includes penalties such as large fines or losing your business.

Several acts of legislation have also been put in place to regulate the banking industry following major financial crimes in the past. These laws include the Bank Secrecy Act, The Dodd-Frank Act, and the Federal Reserve Act.

Health

The health industry is also under major scrutiny due to the sensitive consumer information that businesses handle. The major regulation in place in the health industry is the Health Insurance Portability and Accountability Act (HIPAA).

The HIPAA dictates the security, access, and risk resolution for consumer information that businesses must provide in the healthcare industry. Violating any part of the HIPAA can result in a large fine and other more severe punishments.

Pharmaceuticals

The pharmaceutical industry is an offset of the healthcare industry but still contains its own regulations that businesses must follow. Similar to other businesses in healthcare, pharmaceutical businesses are subject to the regulations of HIPAA.

However, another risk businesses in the pharmaceutical industry must be aware of is the Food and Drug Administration (FDA) regulations. Businesses must ensure compliance with FDA regulations in their products to avoid recalls and bans.

Others

Businesses that sell products are under the regulation of one of the largest government agencies.

The Consumer Product Safety Commission (CSPC), established by the Consumer Product Safety Act (CPSA), creates the safety standards for products businesses sell to consumers.

The CSPC can issue recalls and ban products from being sold, so businesses face a serious financial risk if they do not comply with the regulations.

Businesses that process, use, or sell consumer data are also subject to regulations. Online services are more popular than ever, and as such cyber security measures are more heavily regulated.

In recent years, legislation such as the California Consumer Privacy Act (CCPA) and General Data Protection Regulation (GDPR) strictly govern any business that handles consumer data in California and the EU.

How to Implement a Compliance Risk Management Framework

With severe non-compliance risks, your business must know how to implement a compliance risk management framework properly.

Here are the steps your business can follow to effectively implement a risk management framework:

Identify Applicable Laws and Compliance Frameworks

The first step is identifying the laws and regulations relevant to your business. These industry-specific regulations or laws dictate how your business should conduct its practices.

After identifying the regulations, you can use the compliance frameworks set by government agencies to compare your business’s compliance policies alongside the relevant framework and look for discrepancies.

The compliance risk management framework will allow your business to identify these risks and stay updated with any changes or new regulations issued.

Implement Mitigation Measures

A compliance risk management framework will enable you to assess non-compliance risks within your business. Mitigation measures are the steps your business takes to decrease the chance of any procedures or practices that do not meet the regulations in place.

Mitigation measures include risk assessments and reporting. Conduct risk assessments to gauge your business’s compliance compared to the relevant frameworks.

A risk assessment will identify areas where your business may fail to comply now or in the future. The upper-level management or appropriate compliance officer can make the necessary changes upon identifying these risks.

Develop Policies and Procedures

After identifying any differences or gaps in your business’s current compliance program, you must make adjustments. If your business does not have a compliance program, you can use a compliance framework as a guideline to create one.

Your compliance program should include the policies and procedures to set a compliance standard for your business. Upper-level management will develop policies for employees and implement GRC solutions according to your risk management framework.

After creating or correcting your business’s compliance procedures, you must train your employees to follow them. You should introduce new employees to these procedures upon joining and provide existing employees with updated training.

Continuous Monitoring and Improvement

After implementing a new compliance program and mitigation measures, you must continuously monitor their effectiveness. Part of a successful compliance risk management framework is monitoring your compliance program and improving areas that pose risks.

You can enlist a third party’s compliance services like Captain Compliance to audit your business and compliance program. You should get these audits done periodically in addition to the monitoring you conduct of your own business.

Continuous updating of regulations means you must also update your compliance practices. A successful compliance risk management framework will allow you to identify and mitigate risks and ensure continued compliance.

Need help with implementing a compliance risk management framework? Captain Compliance has your back. Get in touch for a free consultation today.

FAQs

What Is a Compliance Management Framework?

A compliance management framework identifies and assesses your business’s risks for non-compliance with industry regulations and then implements mitigation and prevention procedures to reduce these risks.

What is an example of a Compliance Framework?

The California Consumer Privacy Act (CCPA) is an example of a compliance framework. The CCPA is recent legislation that protects consumers’ information by giving them more control over how businesses use and sell the consumer data they collect.

What are the Components of a Risk Management Framework?

The components of a risk management framework are a compliance program, a commitment to compliance from upper management, a consumer feedback system, and continuous audits of your compliance system by third parties.

What Makes a Risk Management Framework Effective?

An effective risk management framework will include a regular risk assessment using up-to-date compliance frameworks as a reference. After identifying any compliance risks, compliance work will include mitigation measures and prevention strategies to reduce or eliminate these risks.

What is a Risk Assessment Framework?

A risk assessment framework is the system that business uses to find risks in their procedures and gauge the level of the risk. Unlike risk management frameworks, risk assessment frameworks only go so far as to identify the risks.

How Can Captain Compliance Help?

Need help with your compliance with relevant regulations? You could outsource compliance to Captain Compliance, which will ensure your compliance while you focus on business.

With Captain Compliance, you can get professional help creating a risk management framework and performing regular inspections of your program in one suite of services.

Get in touch today for a consultation that is 100% free of charge!