If you do business in Colorado and/or California, you must understand the data privacy laws of these locales and how they differ to achieve effective compliance.

The Colorado Privacy Act (CPA) and the California Consumer Privacy Act (CCPA) are two relatively similar data privacy laws in the United States. Yet, they vary in scope, approach, and business requirements (among other areas).

This guide unpacks the most significant similarities and differences between these comprehensive data privacy laws to help inform your business’s compliance efforts.

Let’s get into it!

Key Takeaways

The Colorado Privacy Act (CPA) and the California Consumer Privacy Act (CCPA) are two of the earliest and most protective data privacy laws in the United States.

In many ways, these laws are similar and have many regulations for businesses that fall under the scope of both. That being said, both laws also differ in significant ways worth looking at more closely.

Understanding the similarities and distinctions between the CPA and CCPA sets your business up for accurate, seamless compliance.

What is the Colorado Privacy Act (CPA)?

What is the Colorado Privacy Act (3).jpg

The CPA is Colorado’s consumer data protection law. It was passed on July 8, 2021, and went into full force on July 1, 2023.

This law gives consumers (i.e., Colorado’s residents) more control over their personal data by having businesses comply with several requirements to handle their information responsibly.

To ensure total conformity, the CPA hands over its enforcement to the Colorado Attorney General (AG) and its district attorneys. Together, they hold the authority to investigate and, if necessary, take action against businesses that violate the law.

So, does this law apply to your business?

The CPA covers you (regardless of your location) if you operate in Colorado or sell products and services to its residents and either one of the following is true:

You handle the personal data of at least 100,000 consumers annually

You gain revenue from selling personal data and handle the personal data of at least 25,000 consumers.

CPA compliance involves fulfilling several requirements, including performing data protection assessments, maintaining a transparent privacy policy, submitting timely data breach notifications, and more.

What is the California Consumer Privacy Act (CCPA)?

What is the California Consumer Privacy Act.jpg

The CCPA is California’s consumer privacy law that was enacted in June 2018 and took effect on January 1, 2020. It was updated by the California Privacy Rights Act (CPRA), which came into force on January 1, 2023.

As the first law of its kind in the US, the CCPA has served as a blueprint, setting the stage for a wave of data laws being passed state by state. That said, the CCPA isn’t without its own source of inspiration.

Specifically, it was inspired by the EU’s General Data Protection Regulation (GDPR) to protect California’s residents in similar ways as the GDPR protects EU residents.

Like the GDPR, the CCPA has a global reach. It applies to for-profit businesses (anywhere in the world) that operate in California or collect the personal information of California’s residents and meet any of the following criteria:

Gross annual revenue is at least $25 million

Annually buy, sell, receive, or share the personal information of at least 100,000 California consumers, households, or devices

Make 50% or more of annual revenue from selling or sharing California consumers’ personal information

Compliance with CCPA includes many of the same obligations imposed by Colorado’s law, save for a few differences in the specifics.

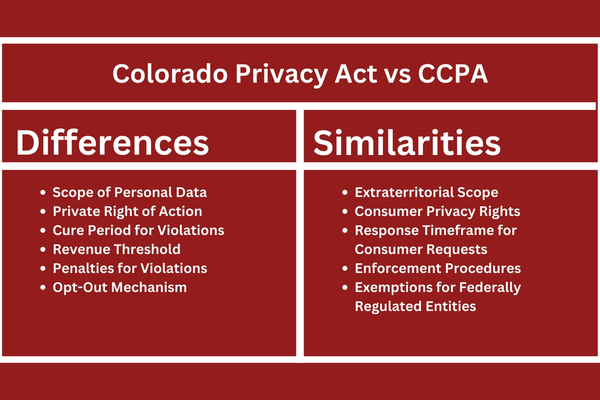

Differences Between the Colorado Privacy Act and the California Consumer Privacy Act (CCPA)

Colorado Privacy Act vs CCPA.png

When it comes to data privacy compliance, the devil is in the details. So, while the CPA and CCPA broadly aim to protect consumer privacy, their specific approaches differ.

This highlights the importance of tailoring your compliance strategies to each state’s specific standards.

Let’s briefly examine the most important ones:

Scope of Personal Data

Colorado’s CPA and California’s CCPA both regulate and protect the personal data of their respective residents. However, the scope of the term “personal data” differs between both laws.

Colorado’s CPA adopts a broader definition, including both personal data (such as names, email addresses, phone numbers, etc.) and sensitive data (such as racial or ethnic origin, religious beliefs, and biometric data).

In contrast, the initial version of the CCPA focused only on personal information, excluding sensitive data (also known as sensitive personal information) from its scope. That being said, sensitive data is now covered under California’s law, thanks to the CPRA amendment.

Private Right of Action

One of the most notable differences between these laws is the provision for a private right of action.

The CCPA allows consumers to bring private lawsuits against a business if a data breach occurs due to the business’s negligence. All other non-compliance issues are handled by California’s Attorney General.

In contrast, only Colorado’s Attorney General and its district attorneys are authorized to enforce the CPA. This means Colorado consumers cannot directly sue businesses for violations of the law.

Cure Period for Violations

Timeframes for addressing alleged violations also vary under both laws. The CPA gives businesses a generous 60-day “cure period” to correct non-compliance issues before the Attorney General or district attorneys take enforcement action.

This 60-day cure period is double the 30-day cure period under the CCPA, giving businesses under Colorado’s law an extended window to address and resolve issues.

Revenue Threshold

Another key difference is the absence of a revenue threshold in Colorado’s law. Unlike California’s CCPA, which applies to businesses with an annual gross revenue exceeding $25 million, the CPA extends its coverage to all businesses, regardless of their financial scale.

Penalties for Violations

Unlike California’s law, Colorado’s CPA doesn’t specify the exact penalties businesses may face for non-compliance. Instead, it gives Colorado’s Attorney General and its district attorneys the power to decide appropriate penalties on a case-by-case basis.

That said, non-compliance with CPA is currently considered a deceptive trade practice under the Colorado Consumer Protection Act. It attracts fines ranging from $2,000 to $20,000 per violation.

Conversely, the CCPA’s fines can get as high as $2,500 (USD) for each accidental violation and up to $7,500 (USD) for each intentional violation.

Opt-Out Mechanism

The CPA introduces a unique feature for its opt-out method – the “user-selected universal opt-out mechanism.” This provision sets Colorado’s law apart from other state laws, allowing consumers to opt out of data sales and targeted advertising seamlessly.

Note: All CPA-covered businesses must support this mechanism starting July 1, 2024. To that end, Colorado’s Attorney General will release the technical standard on or before this date.

In contrast, California’s law does not explicitly require a universal opt-out mechanism. However, it does require businesses to give consumers a way to opt out of selling or sharing their personal information with third parties.

Similarities Between the Colorado Privacy Act (CPA) and the California Consumer Privacy Act (CCPA)

If your business falls under the scope of the CPA and CCPA, their similarities may give you a headstart on your compliance efforts. In other words,

Let’s briefly go over each to give you a breakdown of their shared features.

Extraterritorial Scope

One key similarity between the CPA and CCPA is their extraterritorial scope of application.

Both laws cast a pretty wide net, covering businesses all over the world that target their respective residents and handle the personal data of at least 100,000 consumers annually.

Consumer Privacy Rights

Both Colorado’s CPA and California’s CCPA give their respective consumers significant control over their personal information through several fundamental rights.

In particular, both laws give consumers the right to:

Be informed about data collection

Access their personal data

Correct errors in their personal data

Request deletion of their personal data

Opt out of the sale of their data, targeted advertising, and profiling

This shared emphasis reflects a unified goal to prioritize and safeguard individual privacy in the digital age.

Response Timeframe for Consumer Requests

To enhance transparency and accountability, both laws require businesses to respond promptly to consumer requests – generally known as a Data Subject Access Request (DSAR)

Whether it’s the right to access personal information or the right to opt out of data sales, businesses under the CPA and CCPA have 45 days to respond to DSARs (unless a valid exemption applies).

Enforcement Procedures

Before taking enforcement action against non-compliant businesses, both the CPA and CCPA require the respective state authorities to issue “notices of violations.” This notice serves as a warning, giving businesses a chance to fix issues before facing potential penalties.

Exemptions for Federally Regulated Entities

Both Colorado’s CPA and California’s CCPA exempt certain organizations already regulated under federal laws.

This way, businesses already subject to federal laws (such as HIPAA, COPPA, FCRA, etc.) are not burdened with redundant compliance measures.

Kick Off Your Compliance Journey with Captain Compliance

Compliance isn’t a one-size-fits-all game. The CPA and CCPA are two consumer privacy laws with relatively similar data protection standards – yet their specific provisions differ.

To comply with both frameworks and keep the process as seamless as possible, it’s a smart move to outsource this vital obligation to professionals. And that’s where we come in!

At Captain Compliance, we’re deeply aware of how burdensome compliance can be, so our mission is to simplify this process and help you approach compliance with confidence.

Our team of experts will assess your current practices, implement necessary changes, and provide ongoing support to ensure your business aligns seamlessly across borders.

Ready to achieve cross-jurisdictional compliance with ease? Get in touch today!

FAQs

What is the scope of the CPA and the CCPA?

The CPA applies to businesses that handle the personal data of at least 100,000 Colorado residents annually or derive revenue from the sale of data and handle the data of at least 25,000 Colorado residents.

In contrast, the CCPA applies to businesses that operate in California, collect its residents’ information, and meet one of the following:

Annual gross revenues exceed $25 million

Buy, receive, sell, or share the personal information of 100,000 or more California residents, households, or devices

Derive at least half of their annual revenue from selling the information of California residents

Read more about the exemptions under Colorado’s law

What are the key rights granted to consumers under the CPA and CCPA?

Both the CPA and CCPA grant consumers a range of privacy rights, including the right to access, correct, delete, and opt out of data sales and targeted advertising.

See also: Consumer Rights Under the Virginia’s CDPA

What are the penalties for violating the CPA and CCPA?

The CPA doesn’t specifically highlight penalties for violating its provisions. Instead, the law leaves penalty administration to the discretion of the Colorado Attorney General and its district attorneys.

On the other hand, the CCPA imposes civil penalties of up to $2,500 per violation and $7,500 per deliberate violation on non-compliant businesses.

See also: Connecticut’s Data Act Fines

Can customers sue my business for violations under the CPA and CCPA?

The CPA does not provide for a private right of action. This means Colorado’s consumers cannot directly sue your business for violations of the law. Enforcement is solely in the hands of Colorado’s Attorney General and district attorneys.

In contrast, the CCPA allows California’s consumers to sue – but only in limited circumstances. Specifically, consumers can only sue you if their unencrypted personal information is compromised in a data breach due to your negligence.