Starting January 1st, 2026 another set of requirrements and regulations for CCPA compliance is now coming into enforcement. We provide a detailed summary below and we ask that you book a demo with our privacy software team so that we can implement and automate the privacy requirements for your organization. As a leader in the data privacy field we look forward to helping you deal with these new CCPA requirements.

Updated Summary of California Consumer Privacy Act

On September 23, 2025, the California Privacy Protection Agency (CPPA) finalized a comprehensive package of updated California Consumer Privacy Act (CCPA) regulations, confirmed for implementation on January 1, 2026. These regulations represent the most significant expansion of California privacy requirements since the CCPA’s initial enactment, introducing mandatory cybersecurity audits, formal risk assessment protocols, and extensive automated decision-making technology (ADMT) oversight requirements.

For in-house legal teams and privacy practitioners, the stakes are considerable. Unlike previous CCPA updates that included grace periods, these regulations take effect immediately on January 1, 2026, with no delayed enforcement window and now multiple states are teaming up for enforcement. However, the most resource-intensive requirements related to cybersecurity audits, risk assessments, and ADMT compliance operate on staggered timelines extending through 2030, providing organizations with a critical window to establish robust compliance frameworks.

This guide provides actionable implementation strategies, real-world compliance scenarios, and a practical roadmap for privacy teams navigating these complex new obligations.

Understanding the Regulatory Landscape in California

The updated CCPA regulations address three primary compliance domains:

Immediate Compliance Requirements (Effective January 1, 2026): Public-facing consumer rights mechanisms, privacy policy updates, dark pattern prohibitions, and consent management protocols. All of these can be resolved with the software tools available from CaptainCompliance.com.

Near-Term Compliance Requirements (2027-2028): Automated decision-making technology disclosures, risk assessment frameworks, and annual reporting obligations.

Long-Term Compliance Requirements (2028-2030): Comprehensive cybersecurity audit programs scaled to organizational revenue thresholds.

The CPPA has structured these requirements to balance consumer protection objectives with practical implementation timelines for businesses. Privacy teams should view 2026 as the foundation year for building compliance infrastructure that will support increasingly sophisticated regulatory obligations through the end of the decade.

Immediate Action Items: January 1, 2026 Requirements

1. Opt-Out Confirmation Display Requirements

What Changed: Businesses must now provide visible confirmation that opt-out requests, including Global Privacy Control (GPC) signals, have been processed. This transforms what was previously a discretionary best practice into a mandatory requirement.

Real-World Implementation:

A retail e-commerce company with 2 million California visitors monthly must now display “Opt-Out Request Honored” or similar confirmation messaging directly on their website. The company implemented a persistent banner in the site header that appears for 30 days after processing an opt-out request, with a toggle switch in the user’s account privacy settings showing opt-out status.

Compliance Checklist:

- ☐ Implement visible confirmation mechanism (toggle, radio button, or banner)

- ☐ Ensure confirmation displays for GPC signals received via browser

- ☐ Update privacy preference center to show real-time opt-out status

- ☐ Test confirmation display across desktop, mobile, and app interfaces

- ☐ Document opt-out processing workflow for audit purposes

Technical Consideration: Organizations must track opt-out requests in their consent management platform and trigger confirmation displays that persist across user sessions. This requires integration between your consent management system, customer data platform, and web content management system.

The timing is critical given the CPPA’s September 9, 2025 announcement of joint enforcement sweeps with Colorado and Connecticut specifically targeting GPC compliance. Organizations failing to honor and display GPC opt-outs face immediate enforcement risk.

2. Cookie Consent Banner Redesign

What Changed: The CPPA has eliminated ambiguity around cookie consent mechanisms. Closing or navigating away from a consent banner without affirmatively clicking an acceptance button cannot constitute valid consent. The regulations explicitly classify this practice as a confusing dark pattern.

Real-World Implementation:

A financial services company previously relied on implied consent when users closed their cookie banner. Under the new rules, they redesigned their banner to require explicit “Accept All” or “Reject All” actions before users can access the site. The company also ensured their “Reject All” button matched the size, color prominence, and positioning of the “Accept All” button to satisfy symmetry requirements.

Compliance Checklist:

- ☐ Remove “X” or close functionality that implies consent

- ☐ Require affirmative “Accept” action before setting non-essential cookies

- ☐ Ensure “Accept” and “Reject” buttons have equal visual prominence

- ☐ Implement banner blocking that prevents site access without a choice

- ☐ Test cookie-setting mechanisms to verify compliance

- ☐ Update privacy policy to reflect new consent approach

Design Standards: The regulations specify that consent buttons must be symmetrical in size, color, and prominence. A “Yes” button that is larger or more visually prominent than a “No” button violates the equal choice requirement.

Organizations must also consider the consent flow’s impact on user experience. Privacy teams should work with UX designers to create compliant banners that balance regulatory requirements with conversion rate objectives.

3. Opt-Out Process Symmetry

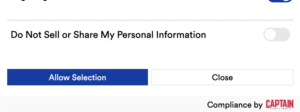

What Changed: The number of steps required for a consumer to opt out of data selling or sharing must be equal to or fewer than the steps required to opt in. This applies to the entire user journey from clicking “Do Not Sell or Share My Personal Information” through completion.

Real-World Implementation:

A media company’s original opt-in process required two clicks: one on the privacy preference link and one confirmation button. Their opt-out process required four clicks: navigating to privacy settings, finding the opt-out section, toggling the preference, and confirming the choice. The company streamlined the opt-out process to match their opt-in flow, implementing a single-click opt-out directly from the privacy preference link with inline confirmation.

Compliance Checklist:

- ☐ Map current opt-in and opt-out user journeys

- ☐ Count steps in each process (clicks, form fields, page loads)

- ☐ Redesign opt-out process to match or reduce opt-in step count

- ☐ Eliminate unnecessary confirmation pages or friction points

- ☐ Test both processes with actual user accounts

- ☐ Document process parity for compliance records

Process Definition: A “step” includes any action the consumer must take: clicking a link, loading a new page, completing a form field, or clicking a confirmation button. Navigation within the same page without a new page load may count as a single step if it requires user action.

4. Financial Incentive Program Defaults

What Changed: Businesses can no longer pre-select consumer enrollment in financial incentive programs (such as loyalty programs that offer discounts in exchange for data collection). The opt-in choice cannot be more prominent than the option to decline participation.

Real-World Implementation:

A grocery chain’s loyalty program signup form previously had the enrollment checkbox pre-selected. Under the new rules, they redesigned the enrollment screen to present “Join Program” and “No Thanks” as equally sized buttons with neutral positioning. The company also revised their point-of-sale terminal prompts to require explicit cashier action rather than defaulting to enrollment.

Compliance Checklist:

- ☐ Remove all pre-selected enrollment checkboxes

- ☐ Ensure enrollment and declination options have equal prominence

- ☐ Update point-of-sale systems to require affirmative enrollment choice

- ☐ Revise financial incentive notices to explain the value exchange clearly

- ☐ Train customer-facing staff on compliant enrollment procedures

5. Extended Lookback Period for Access Requests

What Changed: If your organization retains personal information for longer than 12 months, your consumer request mechanisms must allow individuals to request data from any point back to January 1, 2022. This extends the previously standard 12-month lookback period.

Real-World Implementation:

A SaaS company with 7-year data retention policies implemented a date-range selector in their consumer rights request portal. Users can now select specific date ranges or choose “All data since January 1, 2022.” The company also updated their data retrieval systems to query archived databases and cold storage systems where older data resides.

Compliance Checklist:

- ☐ Audit data retention periods across all systems

- ☐ Implement date-range selection in request intake forms

- ☐ Enable data retrieval from archive and backup systems

- ☐ Update request processing procedures to handle extended timelines

- ☐ Test retrieval from oldest retention periods (2022 data)

- ☐ Adjust response timeline expectations for complex historical requests

Technical Challenge: Many organizations archive data older than 12-18 months to cold storage or backup systems not designed for rapid retrieval. Privacy teams must work with IT infrastructure teams to establish processes for accessing archived data within the CCPA’s 45-day response window (with one 45-day extension available).

6. Privacy Policy Enhancement: Service Provider Disclosures

What Changed: Privacy policies must now explicitly identify categories of personal information disclosed to service providers and contractors for business purposes, not just disclosures to third parties. This eliminates previous ambiguity and requires more granular vendor disclosure. If you use the Captain Compliance Privacy Notice Generator you will be able to automate ongoing CCPA compliance with the privacy policy requirements.

Real-World Implementation:

An e-commerce company previously listed only third-party data sharing in their privacy policy. They now maintain a comprehensive table showing: (1) personal information categories collected, (2) third parties receiving data, and (3) service providers receiving data. The company created a vendor classification system to distinguish service providers from third parties and updates the policy quarterly as vendor relationships change.

Compliance Checklist:

- ☐ Inventory all service provider and contractor relationships

- ☐ Classify vendors as service providers vs. third parties

- ☐ Identify personal information categories shared with each vendor

- ☐ Update privacy policy with service provider disclosure table

- ☐ Establish quarterly review process for vendor relationship changes

- ☐ Ensure contracts with service providers support disclosure accuracy

7. Mobile Application Privacy Policy Links

What Changed: Mobile applications must include a direct link to the privacy policy within the application’s settings menu. This transforms a previous “may include” recommendation into a mandatory “must include” requirement.

Compliance Checklist:

- ☐ Review all mobile applications (iOS, Android, other platforms)

- ☐ Add privacy policy link to in-app settings menu

- ☐ Ensure link displays the full privacy policy (not summary)

- ☐ Test links across app versions and operating systems

- ☐ Update app store listings if necessary

- ☐ Plan app updates and deployment timeline before January 1, 2026

8. IoT and Connected Device Opt-Out Timing

What Changed: For personal information sold or shared through connected devices (smart TVs, wearables, IoT devices), businesses must provide opt-out notices before or at the time the device begins collecting the data. Similarly, for augmented reality or virtual reality environments, opt-out notices must appear before entering the environment or upon encountering the business within it.

Real-World Implementation:

A smart home device manufacturer now displays an opt-out notice during the initial device setup process, before any data collection begins. Users must acknowledge the notice and make an opt-out choice before proceeding. The company also implemented a persistent opt-out link accessible from the device’s companion mobile app.

Compliance Checklist:

- ☐ Identify all IoT, wearable, and connected device products

- ☐ Implement opt-out notices in device onboarding flows

- ☐ For AR/VR products, display notices before environment entry

- ☐ Ensure notices appear before data collection initiates

- ☐ Provide alternative access to opt-out mechanisms (companion apps)

- ☐ Test notice timing and display across device types

9. Insurance Industry Scope Clarification

What Changed: The regulations clarify that insurance companies must comply with CCPA requirements for any personal information not governed by the California Insurance Code. This includes marketing data, website visitor data, and employee or job applicant information.

Compliance Checklist for Insurance Companies:

- ☐ Segregate Insurance Code-governed data from other personal information

- ☐ Apply full CCPA compliance to marketing databases

- ☐ Implement consumer rights mechanisms for website visitors

- ☐ Ensure employee and HR data compliance (including applicants)

- ☐ Update privacy policies to clarify scope distinctions

- ☐ Train staff on dual compliance frameworks

Near-Term Compliance Requirements (2027-2028)

Automated Decision-Making Technology (ADMT) Requirements

Effective Date: January 1, 2027 for existing ADMT systems; immediate compliance required for new ADMT implementations after January 1, 2027.

Scope: The regulations introduce comprehensive requirements for businesses using “automated decision-making technology” that substantially replaces human decision-making for significant decisions affecting California consumers.

Significant Decisions Include:

- Financial or lending services

- Housing opportunities

- Educational enrollment or opportunities

- Employment or compensation decisions

- Healthcare services

Key Exclusion: Advertising to consumers, by itself, does not constitute a significant decision under these rules.

Required Compliance Elements:

- Pre-Use Notice Requirements

- Conspicuous disclosure of ADMT use for significant decisions

- Specific purpose explanation

- Description of how the technology makes decisions

- Output type information

- Alternative process for consumers who opt out

- Consumer Rights Mechanisms

- Opt-out right from ADMT significant decisions

- Access request right to information about ADMT use

- Clear instructions for exercising both rights

Real-World Implementation:

A fintech company uses algorithmic underwriting for personal loan applications. By January 1, 2027, they must implement a pre-use notice on their loan application page explaining: (1) they use automated technology to evaluate creditworthiness, (2) the specific factors the algorithm considers, (3) how the algorithm generates approval or denial decisions, (4) consumers can opt out and receive human review, and (5) how to request information about how the technology evaluated their application.

The company also established an alternative underwriting process using human underwriters for consumers who opt out, ensuring decision quality parity between automated and manual processes.

Compliance Checklist:

- ☐ Inventory all automated systems making significant decisions

- ☐ Classify systems as ADMT vs. decision-support tools

- ☐ Draft pre-use notices for each ADMT system

- ☐ Implement opt-out mechanisms with alternative decision processes

- ☐ Create access request procedures for ADMT information

- ☐ Train staff on ADMT disclosures and alternative processes

- ☐ Document ADMT functionality for consumer explanations

- ☐ Test opt-out and access request workflows

Privacy Risk Assessments

Effective Date: Risk assessments for pre-2026 activities must be completed by December 31, 2027. First annual summary report due April 1, 2028.

Triggering Activities (Significant Risk Determination):

- Selling or sharing personal information

- Processing sensitive personal information

- Using ADMT for significant decisions

- Training ADMT or facial recognition technology with personal information

- Using automated processing to infer consumer attributes based on systematic observation

- Using automated processing to infer attributes based on presence in sensitive locations (healthcare facilities, domestic violence shelters, places of worship, legal services offices, etc.)

Assessment Requirements:

Risk assessments must evaluate:

- Types of personal information processed

- Purpose and context of processing

- Consumer benefits and risks

- Safeguards implemented to mitigate risks

- Whether benefits outweigh risks

Annual Reporting Obligations:

Beginning April 1, 2028, businesses must submit annual summary reports to the CPPA containing:

- Number of risk assessments conducted or updated

- Whether assessments involved sensitive data

- Signed attestation from executive management under penalty of perjury

Critical Distinction: Unlike other state privacy laws, California’s CCPA applies to employment and B2B contexts. Risk assessments must therefore include employee, contractor, job applicant, and business contact data, not just consumer data.

Real-World Implementation:

A healthcare technology company processes patient data, employee data, and uses machine learning for appointment scheduling optimization. They conducted separate risk assessments for:

- Patient health record processing (sensitive personal information)

- Employee wellness program data (HR context, systematic observation)

- ML appointment scheduling algorithm (ADMT for service delivery)

Each assessment documented data types, processing purposes, risk factors, mitigation controls, and benefit-risk balance. The company designated their Chief Privacy Officer to sign the annual summary attestation and established a quarterly risk assessment review cycle.

Compliance Checklist:

- ☐ Identify all activities meeting significant risk criteria

- ☐ Prioritize assessments based on risk level and complexity

- ☐ Develop risk assessment template and methodology

- ☐ Conduct assessments for pre-2026 activities by December 31, 2027

- ☐ Establish ongoing assessment process for new activities

- ☐ Designate executive management signatory for annual reports

- ☐ Implement risk assessment documentation and version control

- ☐ Prepare for potential CPPA requests for full assessment copies

- ☐ Include employment, contractor, and B2B data in assessment scope

Cybersecurity Audit Requirements

Effective Dates (Revenue-Based):

- Annual revenue >$100 million: Audits required starting 2028

- Annual revenue $50-100 million: Audits required starting 2029

- Annual revenue <$50 million: Audits required starting 2030

Applicability Thresholds:

Audits are required if a business meets either:

- Earned 50% or more of gross global revenue from selling or sharing personal information, OR

- Had $26.625 million in gross global revenue AND processed either:

- Personal information of 250,000+ consumers/households, OR

- Sensitive personal information of 50,000+ consumers

18-Point Audit Framework:

Audits must evaluate:

- Asset inventory and classification

- Access controls and authentication

- Network segmentation

- Data encryption (at rest and in transit)

- Vulnerability management

- Patch management procedures

- Multifactor authentication implementation

- Security monitoring and logging

- Incident response procedures

- Business continuity and disaster recovery

- Security awareness training

- Third-party risk management

- Data retention and disposal

- Physical security controls

- Vendor and service provider oversight

- Security governance structure

- Compliance monitoring

- Security testing and assessment programs

Auditor Requirements:

- Internal or external auditors with defined qualifications

- Findings must be based on evidence, not management assertions

- Sampling, testing, document review, and interviews required

- Written certification submitted to CPPA annually in April

- Executive management signature under penalty of perjury

Real-World Implementation:

A mid-market e-commerce company with $75 million revenue processing data for 500,000 California consumers must complete their first cybersecurity audit by the end of 2029. They engaged an external auditor with CISSP and CISA certifications to conduct the assessment.

The audit process included:

- Documentation review of all 18 audit components

- Technical testing of encryption, access controls, and MFA

- Interviews with IT security, legal, and executive teams

- Sampling of vendor security assessments and contracts

- Testing of incident response and business continuity procedures

The company’s CEO signed the certification submitted to the CPPA in April 2030, and the full audit report was retained for potential regulatory review.

Compliance Checklist:

- ☐ Determine audit timeline based on revenue threshold

- ☐ Conduct gap analysis against 18-point framework

- ☐ Select internal or external qualified auditors

- ☐ Implement missing security controls before audit

- ☐ Prepare documentation for auditor review

- ☐ Schedule audit to complete before certification deadline

- ☐ Designate executive signatory for CPPA certification

- ☐ Establish annual audit cycle and budget

- ☐ Retain audit reports for regulatory requests

Compliance Timeline Roadmap

Q4 2025: Foundation Phase

October – December 2025

Critical Actions:

- Conduct comprehensive gap analysis of January 1, 2026 requirements

- Prioritize high-visibility consumer-facing changes (website, apps, policies)

- Engage development teams for technical implementations

- Draft updated privacy policies and consent mechanisms

- Identify ADMT systems requiring 2027 compliance

- Begin vendor inventory for service provider disclosures

Deliverables:

- Compliance project plan with task assignments

- Technical requirements documentation

- Budget approval for implementation costs

- Vendor and technology assessments

Q1 2026: Implementation Phase

January – March 2026

Critical Actions:

- Deploy all January 1, 2026 requirements (live date)

- Monitor consumer feedback and technical issues

- Conduct user acceptance testing of new features

- Launch employee training on new processes

- Begin ADMT pre-use notice drafting

- Initiate risk assessment framework development

Deliverables:

- Updated website and mobile apps (live)

- Revised privacy policies (published)

- Consumer rights request workflows (operational)

- Incident response plan for compliance issues

Q2-Q4 2026: Stabilization & Planning Phase

April – December 2026

Critical Actions:

- Optimize deployed compliance features based on feedback

- Finalize ADMT compliance strategy for 2027 deadline

- Complete risk assessment methodology and templates

- Identify all significant risk activities requiring assessments

- Begin cybersecurity audit preparation (high-revenue orgs)

- Conduct quarterly compliance monitoring

Deliverables:

- ADMT pre-use notices (drafted)

- Risk assessment framework (finalized)

- Cybersecurity gap analysis (for applicable orgs)

- Quarterly compliance reports

2027: Risk Assessment Completion Year

January – December 2027

Critical Actions:

- January 1: Deploy ADMT compliance for existing systems

- Conduct all required risk assessments by December 31

- Implement ADMT opt-out and access request mechanisms

- Prepare first annual risk assessment summary report

- Continue cybersecurity audit preparation (2028 deadline orgs)

Deliverables:

- ADMT compliance (fully operational by Jan 1)

- Completed risk assessments for all pre-2026 activities (by Dec 31)

- Risk assessment summary report (ready for April 1, 2028 submission)

2028-2030: Audit Implementation Phase

2028: First cybersecurity audits for organizations with >$100M revenue

- Complete audit by December 31, 2028

- Submit certification to CPPA in April 2029

2029: Audits extend to organizations with $50-100M revenue

- Complete audit by December 31, 2029

- Submit certification to CPPA in April 2030

2030: Audits extend to organizations with <$50M revenue (meeting threshold criteria)

- Complete audit by December 31, 2030

- Submit certification to CPPA in April 2031

Technology Solutions for Streamlined CCPA Compliance

The complexity and scope of the additional 2026 CCPA regulations require sophisticated technology infrastructure to manage consumer rights requests, consent mechanisms, data mapping, risk assessments, and audit processes effectively.

CaptainCompliance.com offers comprehensive privacy management solutions specifically designed to address these regulatory requirements:

Consent Management Platform

- Pre-built cookie banners compliant with symmetry and dark pattern prohibitions

- GPC signal detection and processing with automatic opt-out confirmation display

- Consent preference center with toggle functionality for opt-out confirmation

- Cross-device and cross-platform consent synchronization

- Real-time consent analytics and audit trails

Consumer Rights Request Automation

- Intake portal with date-range selection for extended lookback periods

- Workflow automation for access, deletion, and correction requests

- Integration with data warehouses and archive systems for historical data retrieval

- Response deadline tracking and escalation management

- Request authentication and identity verification

Data Mapping and Inventory

- Automated personal information discovery and classification

- Vendor and service provider relationship mapping

- Data flow visualization for third-party and service provider disclosures

- Privacy policy generation based on actual data practices

- Change detection and policy update recommendations

Risk Assessment Framework

- Pre-configured assessment templates aligned with CCPA criteria

- Collaborative workflow for cross-functional assessment completion

- Risk scoring and mitigation tracking

- Annual summary report generation for CPPA submission

- Executive attestation management and version control

ADMT Compliance Tools

- Pre-use notice generation and deployment

- Opt-out mechanism implementation

- Access request processing for ADMT information

- Alternative decision process documentation

- ADMT inventory and classification management

Cybersecurity Audit Preparation

- 18-point framework gap analysis tools

- Evidence collection and documentation management

- Auditor collaboration portal

- Certification generation and submission tracking

- Control testing and remediation workflow

Organizations implementing our category leading software from Captain Compliance will find that our solutions can reduce compliance implementation timelines by up to 99% compared to manual processes, ensure consistency across regulatory requirements, and establish scalable frameworks for ongoing compliance as regulations evolve.

Critical Risk Factors and Enforcement Considerations

High-Risk Compliance Gaps

Based on the CPPA’s recent enforcement priorities and the structure of the new regulations, privacy teams should prioritize the following areas as high-enforcement-risk:

1. GPC Signal Processing The CPPA’s September 2025 announcement of joint enforcement sweeps specifically targeting GPC compliance signals aggressive enforcement in this area. Organizations must ensure technical infrastructure correctly detects, honors, and confirms GPC opt-out signals.

2. Dark Pattern Violations The explicit regulation of symmetry, default selections, and consent mechanisms indicates the CPPA views dark patterns as a priority enforcement area. Asymmetrical opt-out processes and misleading consent flows present immediate risk.

3. Service Provider Disclosures The clarification requiring service provider disclosure in privacy policies addresses a longstanding ambiguity many organizations exploited. Incomplete or inaccurate vendor disclosures will likely face scrutiny.

4. Mobile Application Compliance The shift from “may” to “must” for privacy policy links in app settings suggests the CPPA identified widespread non-compliance. Organizations with mobile applications should audit immediately.

Enforcement Authority and Penalties

The CPPA has broad enforcement authority including:

- Civil penalties up to $2,500 per violation or $7,500 per intentional violation

- Injunctive relief requiring compliance measures

- Audit and investigation powers

- Request authority for risk assessments and audit reports (30-day response requirement)

Additionally, California consumers maintain private right of action for data breaches, creating litigation risk independent of regulatory enforcement.

Documentation and Audit Defense

The risk assessment and cybersecurity audit requirements include provisions for CPPA requests for full documentation. Organizations must maintain:

- Complete risk assessment reports (not just summaries)

- Cybersecurity audit evidence and findings

- Compliance decision documentation

- Vendor contracts supporting service provider classifications

- Consent management logs and consumer request records

This documentation serves dual purposes: regulatory compliance and enforcement defense. Privacy teams should implement document retention policies ensuring availability of compliance evidence for the CPPA’s likely 3-5 year lookback period in enforcement investigations.

Practical Implementation Recommendations

Governance Structure

Establish a CCPA 2026 steering committee including:

- Chief Privacy Officer or DPO (lead)

- Legal counsel

- Information security leadership

- IT infrastructure and development

- Marketing and customer experience

- HR and employee relations (for employment data assessments)

- Executive sponsor (for attestation requirements)

This cross-functional team ensures technical feasibility, legal compliance, operational integration, and executive accountability.

Budget Planning

Organizations should budget for:

- Technology platform costs (consent management, consumer rights, risk assessment tools)

- External audit fees (for cybersecurity audits)

- Legal consultation for complex requirements

- Development resources for website and application updates

- Training and change management

- Ongoing maintenance and monitoring

Mid-market organizations typically allocate $150,000-$500,000 for initial 2026 compliance implementation, with annual recurring costs of $75,000-$200,000 for ongoing compliance operations.

Change Management

Consumer-facing changes (consent banners, opt-out mechanisms, privacy preference centers) impact user experience and potentially conversion rates. Privacy teams should:

- Conduct A/B testing of compliant designs to optimize user experience

- Monitor analytics for drop-off rates and user behavior changes

- Gather customer service feedback on consumer confusion

- Iterate on implementations to balance compliance and experience

Internal process changes require employee training on:

- New consumer rights request workflows

- ADMT disclosure and opt-out procedures

- Risk assessment methodologies

- Cybersecurity audit cooperation

Continuous Monitoring

Compliance is not a one-time implementation but an ongoing program requiring:

- Quarterly privacy policy reviews for accuracy

- Monthly consumer rights request metrics and quality audits

- Continuous vendor relationship monitoring

- Annual risk assessment updates

- Regular consent mechanism testing

- Periodic compliance gap assessments

The 2026 CCPA Regulations Next Steps

The 2026 CCPA regulations represent a maturation of California’s privacy framework, moving from foundational consumer rights to sophisticated risk management and cybersecurity integration. For privacy practitioners and in-house legal teams, these requirements demand strategic planning, cross-functional collaboration, and sustained operational commitment.

The immediate January 1, 2026 requirements focus on consumer-facing transparency and choice mechanisms, requiring swift implementation but offering clear compliance standards. The phased approach to risk assessments and cybersecurity audits provides implementation runway, but organizations should begin preparation immediately to avoid compressed timelines and resource constraints.

Technology solutions like CaptainCompliance.com enable efficient, scalable compliance by automating consumer rights workflows, standardizing risk assessments, and maintaining comprehensive audit trails. Organizations investing in robust privacy infrastructure position themselves not only for regulatory compliance but also for competitive advantage as consumer privacy expectations continue to rise.

Privacy teams should view these regulations as an opportunity to elevate data governance practices, strengthen cybersecurity posture, and build consumer trust through transparent, accountable data handling. Organizations that approach compliance strategically, rather than reactively, will establish sustainable privacy programs capable of adapting to California’s evolving regulatory landscape and emerging privacy requirements in other jurisdictions.

The path to compliance begins with assessment, prioritization, and action. Use this guide as a foundation for your organization’s compliance roadmap, adapt the recommendations to your specific risk profile and business context, and engage stakeholders early to ensure successful implementation across all regulatory deadlines and most importantly work with Captain Compliance to make sure that you implement the software to stay compliant as these changes and requirements take place.