Data Protection Officers add a huge economic benefit in the trust, safety, and optics of a business. Now there is hard data to back up that taking privacy seriously not only creates great brand goodwill but has huge economic benefits outside of protecting you against regulatory fines and lawsuits. The European Union’s General Data Protection Regulation (GDPR) has long been painted as a bureaucratic burden—a costly maze of rules that stifles innovation and drains resources. But a groundbreaking study from France’s data protection authority, the CNIL, flips this script on its head. Released in early 2024 and drawing on fresh insights from thousands of professionals, the research reveals that appointing a Data Protection Officer (DPO) isn’t just a legal checkbox; it’s a smart economic play that can deliver tangible returns. For companies bold enough to embrace GDPR as an opportunity rather than an obligation, the DPO emerges as a strategic powerhouse, turning compliance into competitive advantage.

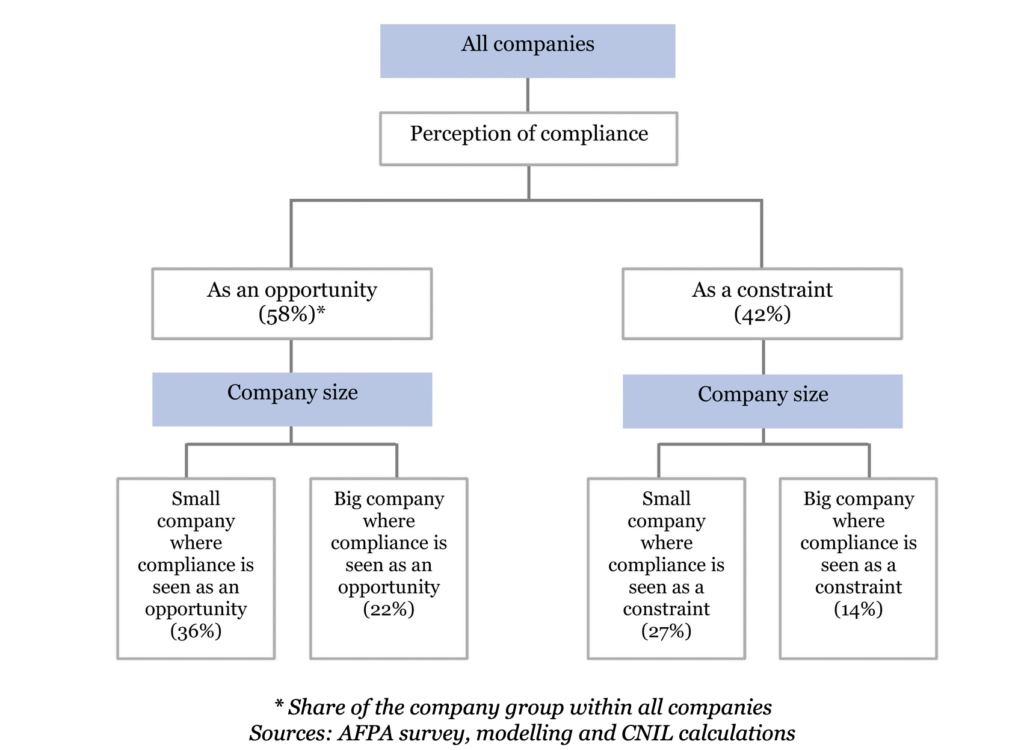

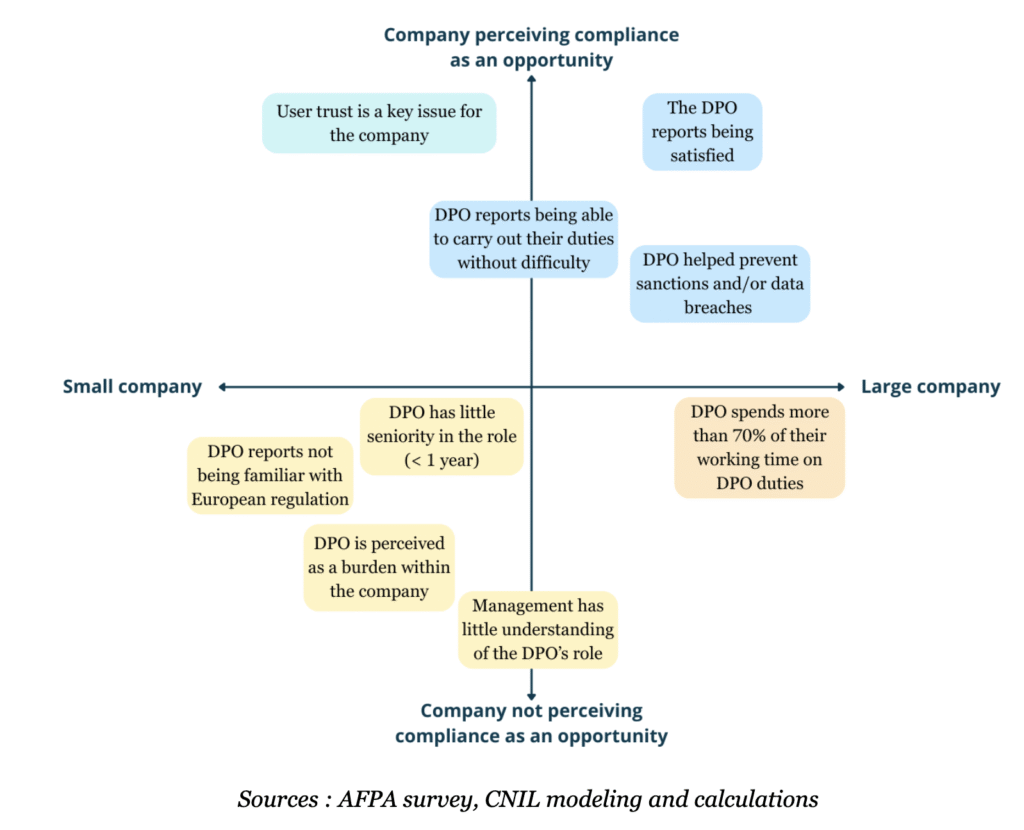

At its core, the CNIL’s analysis—conducted in partnership with the Association for Adult Vocational Training (AFPA) and informed by interviews with the French Association of Data Protection Officers (AFCDP)—surveyed over 3,600 DPOs and used sophisticated statistical tools like Principal Component Analysis to unpack the financial ripple effects of this role. The findings are striking: across sectors from IT consulting to banking, the presence of a dedicated DPO correlates with reduced risks, operational efficiencies, and even revenue boosts. Yet, the benefits aren’t automatic; they hinge on a company’s mindset. Roughly 58% of respondents viewed compliance as a “positive approach,” linking it to innovation and trust-building, while 42% saw it as a constraint—highlighting a clear divide between laggards and leaders.

Consider the tangible upsides. In a cutthroat tendering landscape, where public and private contracts increasingly demand proof of ethical data handling, the DPO serves as a credibility badge. Nearly half of the DPOs surveyed reported that their expertise helped secure bids, with one standout example citing a 50% uptick in successful tenders after weaving GDPR into the company’s corporate social responsibility (CSR) framework. This isn’t mere anecdote; it’s a signal that in an age of data scandals—from breaches to biased algorithms—buyers are prioritizing partners who can demonstrate robust privacy governance. For data-heavy industries like finance and tech, where trust is currency, ignoring this could mean leaving money on the table.

Then there’s the stark reality of sanctions. The CNIL itself doled out 87 fines totaling €55 million in 2024 alone, a sobering reminder of GDPR’s teeth and just recently we broke the news about CNIL fining Google & Shein millions of Euros. DPOs, acting as the frontline advisors and auditors, shield companies from these hits by preempting violations through privacy impact assessments, employee training, and seamless liaison with regulators. But the savings go deeper: beyond fines, DPOs safeguard reputations and financial ratings, which in turn stabilize investor confidence and borrowing costs. In high-stakes environments reliant on intrusive data practices, the DPO isn’t a luxury—it’s insurance against existential threats.

Perhaps the most compelling case for the DPO’s worth lies in averting data breaches, whose global average cost hit $5 million in 2024, up 10% from the prior year, according to IBM. Proactive DPOs mitigate these nightmares by embedding security into daily operations—think audits that uncover vulnerabilities before hackers do, or training programs that slash phishing success rates from 21% to a mere 5%. The result? Not just dodged disasters, but a leaner, more resilient organization. One DPO’s initiative reportedly saved €400,000 in server costs for a €150 million-revenue firm by enforcing GDPR’s data minimization principles, pruning redundant storage and silos that bred inefficiencies and cyber risks alike.

Of course, no role comes without costs—salaries, training, and the opportunity cost of time. The study acknowledges this, noting that profitability peaks when companies invest adequately in their DPOs, granting them the bandwidth to consult strategically rather than firefight reactively. Larger firms and those in data-centric models, where sanction risks loom large, see the quickest ROI. Smaller outfits, however, might balk at the upfront outlay, yet the CNIL’s data suggests even they can profit by integrating the DPO into executive decision-making, aligning privacy with broader IT and CSR goals.

This isn’t just number-crunching; it’s a call to reframe data protection as a value driver. The CNIL draws parallels to environmental regulations, where pioneers who treated sustainability as innovation reaped first-mover advantages, while skeptics footed escalating cleanup bills. In 2025, as AI and big data accelerate, the stakes are higher than ever. Companies that silo compliance in a compliance department risk obsolescence; those that empower DPOs to shape strategy will thrive.

So the data confirms what we’ve been preaching: the DPO is no longer a GDPR relic but an economic asset. Businesses should measure these gains—track tender wins, breach incidents, and efficiency metrics—and evangelize them internally to foster a culture of opportunity. For regulators like the CNIL, the study underscores the wisdom of mandating DPOs under Article 37 of GDPR: it’s not about punishment, but enabling prosperity. In a world drowning in data, the real winners will be those who protect it not out of fear, but foresight.